What’s the Rationale for the Samsonite-Tumi Transaction?

Hong Kong-based Samsonite is buying luxury brand Tumi (TUMI) in a $1.8 billion deal. Samsonite is mainly known as a utilitarian luggage company.

March 9 2016, Published 7:55 a.m. ET

Merger creates a leading travel lifestyle company

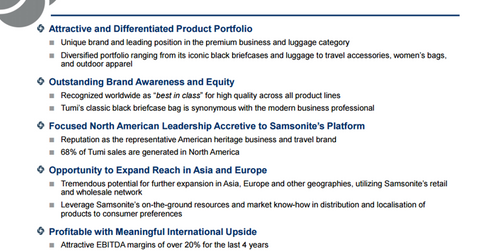

As we saw in the first part of the series, Hong Kong-based Samsonite is buying luxury brand Tumi (TUMI) in a $1.8 billion deal. Samsonite is mainly known as a utilitarian luggage company. Tumi will expand its offerings into more premium or luxury travel accessories. According to the companies, there’s only a little overlap, so there shouldn’t be any cannibalization. The companies expect cost and revenue synergies from the transaction, although they didn’t quantify them in the press release.

Management’s comments

“This is a transformational acquisition for Samsonite. It will meaningfully expand our presence in the highly attractive premium segment of the global business bags, travel luggage and accessories market,” said Ramesh Tainwala, CEO of Samsonite. “Tumi is a perfect strategic fit for our business. The brand is beloved by millions of loyal customers for its high quality and durable premium business and luggage products. We are excited about the tremendous opportunities this combination provides us to further diversify our product and customer portfolios. In particular, we will expand Tumi’s presence in Asia and Europe, while strengthening its business in North America, by leveraging our expertise in global distribution, sourcing, product design and technical innovation, especially in the area of lightweight hardside luggage.”

Other merger arbitrage resources

Other important merger spreads include the Cigna (CI)-Anthem (ANTM) deal. It’s slated to close in 2H16. Another important transaction is Apollo’s purchase of ADT (ADT). For a primer on risk arbitrage investing, read Merger arbitrage must-knows: A key guide for investors.

Investors who are interested in trading in the consumer discretionary sector should look at the Vanguard Consumer Discretionary ETF (VCR).