Rx for Growth? Why Generic Drugs Are Gaining Traction

Rx for Growth? The trillion-dollar pharmaceutical industry has historically been dominated by a few major companies that create and supply the most important branded prescriptions on the market. Recent trends, however, point to the growth of the newest pharma blockbusters: generics. Today, approximately 60% of Americans take prescription drugs;[1. “Trends in Prescription Drug Use Among […]

Nov. 20 2020, Updated 12:49 p.m. ET

Rx for Growth?

The trillion-dollar pharmaceutical industry has historically been dominated by a few major companies that create and supply the most important branded prescriptions on the market. Recent trends, however, point to the growth of the newest pharma blockbusters: generics.

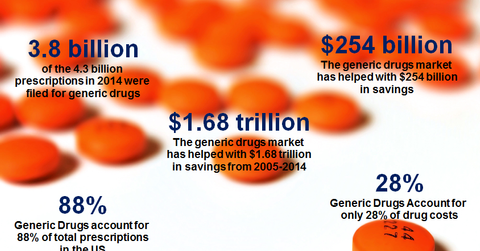

Today, approximately 60% of Americans take prescription drugs;[1. “Trends in Prescription Drug Use Among Adults in the United States from 1999-2012.” The Journal of the American Medical Association, November 3, 2015] generics account for 88% of these prescriptions.[2. “Generic Drug Savings in the U.S. Seventh Annual Edition: 2015.” Generic Pharmaceutical Association, https://www.gphaonline.org/media/wysiwyg/PDF/GPhA_Savings_Report_2015.pdf] Generics are also gaining traction globally, accounting for 55% of prescriptions in the EU [3. Regulatory Efficiency Report 2015.” European Generic and Biosimilar Medicines Association, https://www.egagenerics.com/EGA_Regulatory_Efficiency_Report/#1/z] and 47% in Japan. [4. “Country Overview: Generic Share (%) by the Ministry of Health, Labour and Welfare Drug Price Survey.” Japan Generic Medicines Association, September, 2013, https://www.jga.gr.jp/english/country-overview/genric-share-by-mhlw/] Generic pharmaceutical use in emerging markets is also on the rise, as improved access to health care and regulations favoring the use of lower cost drugs enhance growth potential in developing countries. The Indian pharmaceutical market, in particular, represents a significant opportunity for generic drug manufacturing; it is the world’s third-largest pharmaceutical market in terms of volume and 13th largest in terms of value.[5. “India’s pharma sector pips global growth: report.” Live Mint, December 1, 2015, https://www.livemint.com/Industry/aB3apnr59a8ZFP3aXawuYM/Indias-pharma-sector-pips-global-growth-report.html]

Market Realist

The rise of generics has been a fast and exciting pharmaceutical industry (PPH) trend. Let’s quickly demystify some of the basics.

What are generic drugs?

There are two types of prescription drugs: patented (or branded) and generic. The FDA defines generic drugs as an “equivalent or a bio-equivalent to a brand name drug in dosage, form, safety, strength, route of administration, quality, performance characteristics and intended use.” Pharmaceutical companies patent drugs when they discover them, usually for 12–20 years. Once the patent expires, other companies can enter the market. These other companies’ off-patented products are called generic drugs.

How do generic drugs differ from branded drugs?

Generic drugs (GNRX) are required to have the same active ingredient, strength, dosage, bioequivalence (the amount of the drug in a patient’s bloodstream needs to be the same for both generic and branded drugs), and route of administration as their branded counterparts. The inactive ingredients can vary, however.

This requirement means generic drugs work just as well as branded products and must adhere to similar quality standards as innovator drugs under FDA policy. Contrary to popular belief, there’s very little variation in absorption between innovator drugs and their generic counterparts. According to a study from the FDA based on 2,070 human studies between 1996 and 2007, the average difference in absorption was ~3.5%—not 45% as people often think. The biggest difference between an innovator drug and a generic drug is its price. There’s often an 80%–85% price difference, making generic drugs extremely cost-effective (Source: the FDA).

The ongoing rise of generic drugs

As we’ve seen, generics make up more than 88% of total prescriptions in the United States but only 28% of total drug costs. The rise of generics has indeed been monumental. According to data from Evaluate Pharma, global generic drug sales rose 7% to a massive $74.2 billion in 2014. $61.7 billion (or 83.1%) of total sales came from the top 20 generics producers. The top five—Teva Pharmaceuticals (TEVA), Novartis (NVS), Mylan (MYL), Actavis, and Sun Pharmaceutical—made up 47.4% of global generics drug sales in 2014 and 57% of the sales generated by the top 20 (Source: Fierce Pharma).

The generic drug industry is immense. We’ll delve deeper into this topic in the next parts of this series.

View Current GNRX Holdings.