Did Kellogg’s Earnings Beat Estimates in Fiscal 2Q16?

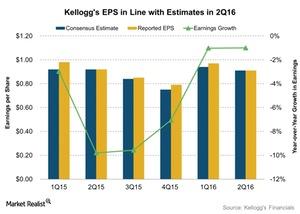

In fiscal 2Q16, Kellogg Company (K) reported EPS (earnings per share) of $0.91, in line with analysts’ estimates.

Aug. 11 2016, Updated 11:04 a.m. ET

Kellogg’s fiscal 2Q16 earnings

In fiscal 2Q16, Kellogg Company (K) reported EPS (earnings per share) of $0.91, in line with analysts’ estimates. EPS fell slightly by 1% year-over-year. The EPS figure included an adverse $0.09 impact from currency headwinds. Out of this impact, $0.06 was from the Venezuelan business. The company’s fiscal 2Q16 net earnings were $336 million, compared to $326 million in fiscal 2Q15. Earnings were ahead of the company’s expectations mainly because of the operating profit performance.

Analysts following Kellogg are expecting its earnings to grow in the second half of 2016, which would lead to earnings growth of 4% for fiscal 2016.

Fiscal 2016 EPS guidance raised

In the fiscal 2Q16 earnings release, the company updated its previous guidance for currency-neutral adjusted EPS for fiscal 2016. The company now expects to see 16%–18% growth in currency-neutral adjusted EPS to $4.11–$4.18 per share. This projection includes a currency translation impact of $0.53 per share.

The EPS guidance excludes the impact of the following items:

- mark-to-market adjustments

- integration costs

- costs related to Project K

- foreign currency translation

- other items that could affect comparability

However, the guidance includes the impact of acquisitions and dispositions. The company had earlier approved a $1.5 billion share repurchase program, which it plans to run through 2016 and 2017. The company repurchased shares worth ~$176 million in the second quarter, which brought the year-to-date total to $386 million. It still expects to repurchase shares worth ~$700 million–$750 million in 2016.

Peers’ earnings

The company’s competitors in the industry include Hormel Foods (HRL), Flowers Foods (FLO), and Snyder’s-Lance (LNCE). They reported earnings growth of 19%, -4%, and 47%, respectively, in their last quarters. To gain exposure to Kellogg, you can invest in the First Trust Consumer Staples AlphaDEX Fund (FXG) and the PowerShares S&P 500 Quality Portfolio (SPHQ). They invest 0.84% and ~1.1% of their respective holdings in Kellogg.

We’ll discuss Kellogg’s updated fiscal 2016 guidance in the next part of this series.