Comparing the Valuation Multiples of Fast Casual Restaurants

A company’s valuation multiple is affected by its perceived growth, risks and uncertainties, and investors’ willingness to pay.

March 25 2016, Updated 9:06 a.m. ET

Valuation multiples

Valuation multiples help investors to decide on entry and exit points in securities. A company’s valuation multiple is affected by its perceived growth, risks and uncertainties, and investors’ willingness to pay.

Forward EV-to-sales ratio

Various multiples can be used to determine stocks’ valuations. We’re using an EV-to-sales (enterprise value) ratio, as three of the eight companies under review are still in the growth phases of their life cycles. During the growth phase, a company’s operating costs will be higher, and EPS can’t be considered for valuation.

The forward EV-to-sales ratio is calculated by dividing the current EV by forecast sales for the next 12 months. Estimated future sales give more visibility to a company’s growth prospects.

Peer comparison

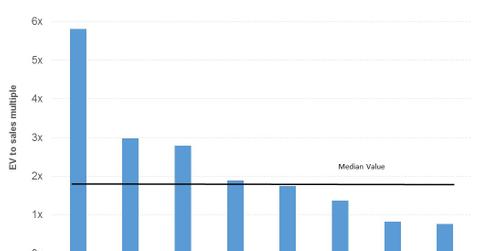

As of March 18, 2016, fast casual restaurants were trading at a median forward EV-to-sales multiple of 1.8x. Since going public in January 2015, Shake Shack’s (SHAK) valuation multiple has been trading in the range of 18.3x–5.8x. As of March 18, the company was trading at its lowest multiple of 5.8x. Investors were disappointed by the guidance set by its management for 2016 during its 4Q15 earnings call.

Compared to the multiples of other companies, 5.8x may look high, but SHAK is in the growth phase of its life cycle. It’s forecast to generate 27.5% more revenue in 2016.

Until an outbreak of E. coli, Chipotle Mexican Grill (CMG) was enjoying higher margins, which raised the company’s share price and valuation multiple. However, the recent food safety issue caused CMG’s share price to fall, and in turn, its valuation multiple fell to 3x from its earlier 4.3x. Investors are still skeptical about the immediate revival of the company.

Currently, Chipotle and Starbucks (SBUX) form about 3.9% of the iShares MSCI USA Momentum Factor ETF (MTUM). Zoe’s Kitchen (ZOES), another young company, was trading at 2.8x, closer to its peak valuation multiple of 3x in the last six months. As the company is expected to continue its 4Q15 performance in 2016, investors are confident about investing in ZOES. This has raised its valuation multiple.

Panera Bread (PNRA), Habit Grill (HABT), Fiesta Restaurant Group (FRGI), Noodles & Company (NDLS), and Potbelly (PBPB) were trading at lower multiples of 1.9x, 1.7x, 1.4x, 0.8x, and 0.76x, respectively.

NDLS’s aggressive expansion despite its negative same-store sales has affected its margins, which are the worst among its peers. This has eroded investor confidence.