Analyzing Crude Oil Inventories and Oil Prices

In the week ending November 24, 2017, US crude oil inventories fell by 3.4 MMbbls (million barrels) to 453.7 MMbbls.

Dec. 6 2017, Published 1:11 p.m. ET

US crude oil stockpiles

In the week ending November 24, 2017, US crude oil inventories fell by 3.4 MMbbls (million barrels) to 453.7 MMbbls. The fall was 0.9 MMbbls more than the market’s expected decline. On November 29, 2017, the EIA (U.S. Energy Information Administration) released the oil inventory data. On the same day, US crude oil prices fell 1.2%. The fall in oil prices could be because of a 3.6 MMbbls rise in total motor gasoline inventories for the week ending November 24, 2017. As we discussed in the previous part, the rise in US crude oil production could also have impacted oil prices negatively.

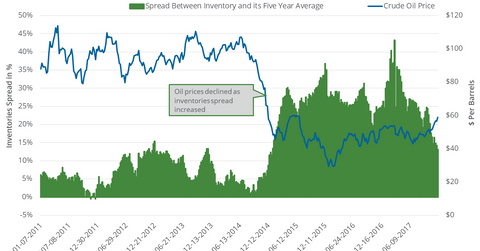

Inventories spread and oil prices

The difference between US oil inventories’ level and their five-year average might influence oil (UCO) (BNO) prices. The “inventories spread” represents this difference. Oil (OIIL) (DBO) (USL) prices might fall due to any rise in the inventories spread and vice versa.

The inventories spread was 13.1% for the week ending November 24—the third consecutive weekly decline. US crude oil prices rose 3.6% from November 3, 2017, to date. Since the release of inventory data on November 29, 2017, US crude oil prices rose 0.6%.

Estimates

The market expects a fall of 3.2 MMbbls in US commercial crude oil stockpiles for the week ending December 1. On December 5, the API reported a fall of ~5.5 MMbbls in oil inventories for the same period. For oil traders, the fall should be greater than ~4.15 MMbbls to see an additional contraction in the inventories spread. The EIA will release oil inventory data on December 6, 2017.