Analyzing Ford Motor Company’s Leverage Position

Ford uses a high amount of financial leverage. At the end of 2015, 70.4% of Ford’s capital structure was made up of debt, while 29.6% was made up of equity.

March 15 2016, Updated 9:05 p.m. ET

Importance of analyzing leverage

Previously in this series, we looked at the factors that have impacted Ford’s (F) margins. It’s also important for an investor to pay attention to a company’s leverage position.

High debt levels increase the risk profile of a company, since debt is a contractual obligation a company must fulfill irrespective of market conditions. In this article, we’ll take a look at Ford’s current leverage position.

Ford’s leverage position

At the end of 2015, 70.4% of Ford’s capital structure was made up of debt, while 29.6% was made up of equity. This debt was significantly higher than that of its direct competitor General Motors (GM), which had a 55.3% contribution of debt to its total capital structure. Ford uses a high amount of financial leverage.

Fiat Chrysler Automobiles (FCAU) has higher leverage than other mainstream automakers. Note that while higher leverage can magnify earnings, it can also put a squeeze on margins as interest rates rise.

Due to the highly capital-intensive nature of the automotive business (FXD), companies tend to utilize debt extensively. Therefore, it’s not always bad to have high leverage. What matters most is a company’s ability to pay back its debt and related interest with ease. A company’s ability to pay back its debt can generally be understood by looking at its interest coverage ratio and its net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization).

As of December 31, 2015, Ford’s net debt stood at $132.9 billion. Its automotive segment’s debt of $12.8 billion showed an impressive reduction from the level of $33.6 billion at the end of 2009. This can be seen as good progress on the path to reduce the company’s debt.

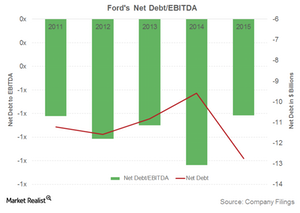

Net debt-to- EBITDA

Both Ford and General Motors have negative net debt in their automotive operations. You can define net debt as total debt minus cash and cash equivalents. It’s a better metric by which to analyze a company’s financial health. Currently, Ford’s net debt-to-EBITDA ratio is -0.8x.

As you can see in the chart above, Ford has been able to reduce its debt level in recent years. The company also has plans to reduce its automotive debt levels further to about $10 billion by 2018. According to the company, this can be done by using cash from operations to make quarterly installment payments.

Continue to the next part to read about Ford’s plan to expand its presence in the electric vehicle segment to compete with Tesla (TSLA) and General Motors.