Will United Parcel Service Increase Its Dividend Payout in 2016?

United Parcel Service (UPS) has been a consistent dividend payer for the last 20 years.

Feb. 17 2016, Updated 3:04 a.m. ET

Consistent dividends

United Parcel Service (UPS) has been a consistent dividend payer for the last 20 years. It has in fact raised dividend payouts in most years. Rival FedEx (FDX) also shares a similar history.

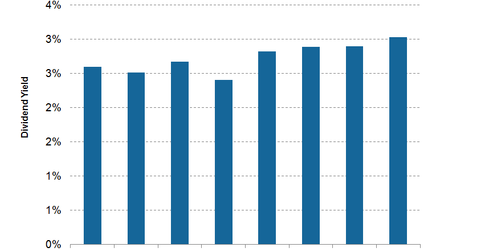

Dividend yields

UPS boasts of one of the highest dividend yields among industry peers. UPS has a current dividend yield of 3.2%, much higher than rival FDX’s dividend yield of 0.77%. Other logistic providers C.H. Robinson Worldwide (CHRW) and Con-way (CNW) have dividend yields of 2.7% and 1.3%, respectively. UPS forms ~2.0% of the iShares Global Industrials ETF (EXI).

Cash dividend ratio

UPS’s cash dividend ratio stood at a strong 2x at the end of 4Q15, indicating its ability to sustain dividend payouts. The ratio is calculated as cash flows over dividends paid, and it measures the ability of the company to pay dividends. A ratio of less than one indicates dividend payouts higher than the company’s cash flows, which may be difficult to sustain in the future.

Can dividend payouts increase?

UPS has a history of increasing dividend payouts. UPS’s dividend payout ratio stands at ~54% in 2015. However, it had higher dividend ratios in the past. Given increasing earnings and UPS’s history of dividend growth, investors can expect an increase in dividends.