Unit Growth and Dunkin’ K-Cup Sales Drove 4Q15 Revenue Growth

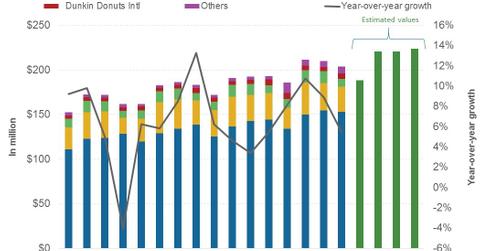

Dunkin’ Brands (DNKN) earns its revenue from five different channels: Dunkin’ Donuts US, Dunkin’ Donuts International, Baskin-Robbins US, Baskin-Robbins International, and others.

Feb. 11 2016, Updated 9:22 a.m. ET

DNKN’s 4Q15 revenues

Dunkin’ Brands (DNKN) earns its revenue from five different channels: Dunkin’ Donuts US, Dunkin’ Donuts International, Baskin-Robbins US, Baskin-Robbins International, and others. The company reported 4Q15 revenues of $203.8 million against the analyst estimates of $203.5 million.

Revenue from Dunkin’ Donuts

Although same-store sales growth of the Dunkin’ Donuts US division fell to -0.8%, the revenue from this segment increased from $144.1 million in 4Q14 to $154.4 million, an increase of 6.2%. The company management claimed that the revenue was driven by increased licensing fees from Dunkin’ K-Cup pod sales, increased royalties due to an increase in systemwide sales, and an increase in company-operated restaurant sales. The increase in system-wide sales was due to an increase in unit growth, which was not part of the comparative base used to calculate same-store sales growth.

The revenue generated from Dunkin’ Donuts’ international division fell from $6.7 million to $6.3 million, a decline of 5.9%. Sales growth in Asia, Europe, and the Middle East was offset by a decline in South Korea and Colombia. Also, the sales from South Korea, Asia, South America, and Europe were negatively impacted by the strong dollar. On a constant currency basis, the systemwide sales rose by 2%.

Baskin-Robbins revenue

With the increase in same-store sales and unit growth, the revenue generated from the Baskin-Robbins US division rose from $8.5 million in 4Q14 to $8.7 million in 4Q15, an increase of 2.3%. However, the revenue generated from the Baskin-Robbins International segment fell from $29.9 million to $28.1 million, a decrease of 5.9% due to negative same-store sales growth of 2.7%.

You can mitigate these company-specific risks by investing in the iShares U.S. Consumer Services ETF (IYC), which has invested 0.14% of its portfolio in DNKN. IYC has also invested 2.8% in Starbucks (SBUX), 0.52% in Chipotle Mexican Grill (CMG), and 0.25% in Darden Restaurants (DRI).

Outlook for 2016

To address the decline in same-store sales, management has developed a five-part plan, which includes coffee innovation culture, faster-to-market product innovation, positive value offerings, increased use of digital technology, and an improved restaurant experience. Through these initiatives, the company expects to increase its revenue by 4% and 6% for fiscal 2016.

The 4Q15 results did not change the analyst estimates by much. Analysts are expecting the revenue for fiscal 2016 to be around $852.9 million, an increase of 5.1% from the company’s 2015 revenue.