Spirit Airlines: New CEO, New Strategy

Spirit Airlines has historically followed a low-cost structure, and took numerous measures to keep its cost components the lowest in the industry.

Feb. 19 2016, Updated 12:05 p.m. ET

Change in leadership

Spirit Airlines (SAVE) welcomed its new CEO, Bob Fornaro, who replaced Ben Baldanza in January. The new CEO has said the airline would focus on improving its passenger experience this year, in addition to making the carrier more reliable.

Model to remain same

Spirit Airlines has historically followed a low-cost structure, and it has taken numerous measures to keep its cost components the lowest in the industry. The airline is able to maintain the lowest airfares because it charges separately for many optional services above its basic airfares, known as Bare Fares. These optional services include checked bags, larger carry-on bags, assigned seats, seat upgrades, snacks and drinks, and boarding passes printed at the airport.

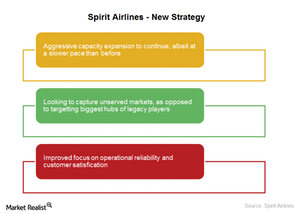

This low-cost strategy has been the biggest reason why the airline has been able to improve its margins and post profitability despite a weak environment in the industry over the years. Fornaro stated that there are no plans to change Spirit’s low-operating-cost cheap-fare strategy that generates revenue from numerous optional services.

Improved customer service

Although Spirit Airlines has the lowest fares, the airline has lagged in its customer service. The airline has suffered due to various issues such as massive delays and misplaced luggage. Under Fornaro’s leadership, the airline plans to focus on improving its on-time performance and maintaining a high completion factor as well as improving its customer service metrics.

Growth focus

Fornaro also said that Spirit Airlines (SAVE) would slow its capacity growth in the coming quarters. This comes in as a measure to let its new markets mature and improve margins. The airline also plans to add flights at small and mid-size airports where bigger airlines do not have as great a cost advantage as they do at their hubs.

Improved service and reliability should go a long way in ensuring repeat business from its passengers. Investors can gain exposure to airline stocks by investing in the iShares Transportation Average ETF (IYT), which invests 4.3% in United Continental (UAL), 4.2% in Alaska Air Group (ALK), and 3.9% in Delta Air Lines (DAL).