Who Were the Outliers in the Consumer Space on September 28?

On September 28, the S&P 500 outperformed the S&P Consumer Discretionary and the S&P Consumer Staples, which saw returns of 0.53%, 0.30%, and 0.11%.

Aug. 18 2020, Updated 6:32 a.m. ET

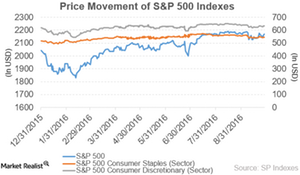

Price movement of S&P 500 indexes

On September 28, 2016, the S&P 500 slightly outperformed the S&P Consumer Discretionary and the S&P Consumer Staples as a whole. The indexes had respective returns of 0.53%, 0.30%, and 0.11%.

The S&P 500 stocks had a year-to-date return of 6.2%. That’s much higher than 2.1% and 5.4%, from the S&P Consumer Discretionary and the S&P Consumer Staples, respectively.

Top loser on September 28

The top losing stocks as of September 28, 2016, were as follows:

Top gainer of September 28

The top gaining stocks as of September 28, 2016, were as follows:

- Trinseo (TSE) rose 2.3%.

- Skechers USA (SKX) rose 1.4%.

- Procter & Gamble (PG) rose 1.2%.

- GoPro (GPRO) rose 1.2%.

- Packaging Corporation of America (PKG) rose 1.1%.

- Thor Industries (THO) rose 1.0%.

The Consumer Staples Select Sector SPDR Fund (XLP) tracks a market-cap-weighted index of consumer staples stocks drawn from the S&P 500. XLP is the ETF of consumer goods.

In this series, we’ll take a look at the above stocks’ performances, price movements, and latest quarterly results.

Let’s start with Tempur Sealy International (TPX).