Thor Industries Inc

Latest Thor Industries Inc News and Updates

Drew Industries Announces Change of Name and Ticker Symbol

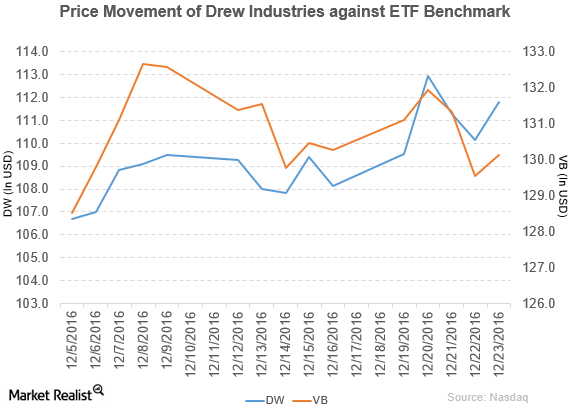

Drew Industries (DW) rose 3.4% to close at $111.80 per share during the third week of December 2016.

Why Sidoti Rated Drew Industries a ‘Buy’

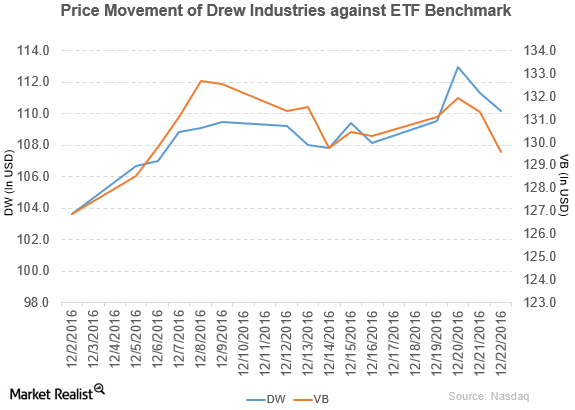

Drew Industries (DW) has a market cap of $2.7 billion. It fell 1.0% to close at $110.15 per share on December 22, 2016.

Under Armour Announces a Change in Its Ticker Symbols

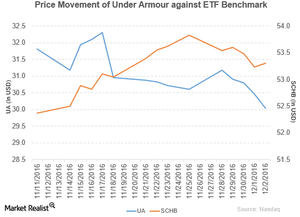

Under Armour (UA) fell 1.9% to close at $30.03 per share during the fifth week of November 2016.

Drew Industries Declares Dividend of $0.50 Per Share

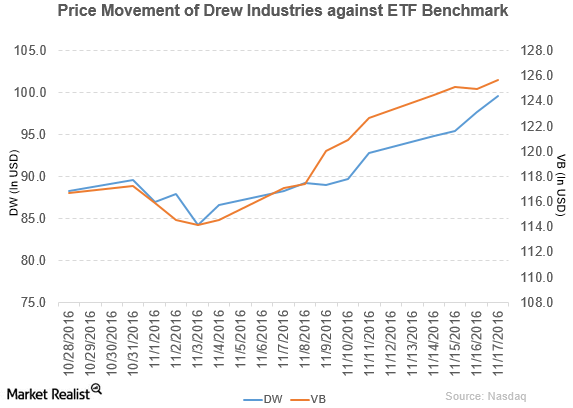

Drew Industries rose 1.9% to close at $99.60 per share on November 17. The stock’s weekly, monthly, and YTD price movements were 11.0%, 7.4%, and 65.5%.

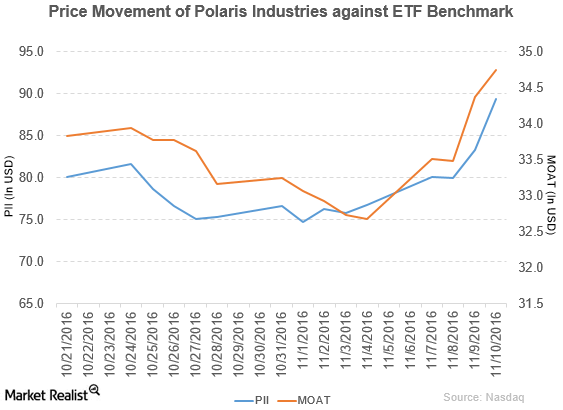

Polaris Industries Acquired Transamerican Auto Parts for $665 Million

Polaris Industries (PII) reported 3Q16 sales of ~$1.2 billion, which represents a fall of 18.5% from its ~$1.5 billion in sales in 3Q15.