Key Drivers of Dr Pepper Snapple’s 4Q15 Sales

Dr Pepper Snapple reported sales of nearly $1.6 billion in 4Q15, beating the consensus Wall Street analyst estimate of $1.53 billion.

Nov. 20 2020, Updated 4:52 p.m. ET

Sales ahead of estimates

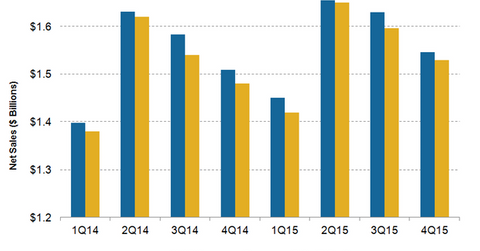

Dr Pepper Snapple (DPS) reported sales of nearly $1.6 billion in 4Q15. The 4Q15 sales of the third-largest soda maker in the US beat the consensus Wall Street analyst sales estimate of $1.53 billion. The company exceeded analysts’ sales estimates in the first three quarters of 2015 as well. Dr Pepper Snapple reported its 4Q15 and full-year results on February 17.

Sales growth drivers

Dr Pepper Snapple’s net sales in 4Q15 increased by 2.5%, driven by favorable product mix, package and segment mix, and price increases. The company’s 4Q15 sales also benefited from lower discounts, primarily in its fountain food service business. Currency headwinds adversely impacted the company’s sales by 2%. Overall, Dr Pepper Snapple’s net sales increased by 2.6% to $6.3 billion in fiscal 2015.

Dr Pepper Snapple’s sales had increased by 3.1% in the fourth quarter of the previous year and by 3% in 3Q15. The iShares Global Consumer Staples ETF (KXI) has 0.5% exposure to Dr Pepper Snapple.

Comparison with peers

Dr Pepper Snapple’s sales growth was better than beverage giants Coca-Cola (KO) and PepsiCo (PEP) in all the quarters of fiscal 2015. With an extensive presence in over 200 countries, the sales of Coca-Cola and PepsiCo were significantly impacted by currency fluctuations. Dr Pepper has lower international exposure because outside of the US, it sells its products in Canada, Mexico, and the Caribbean only.

Coca-Cola’s 4Q15 sales declined by 8%, primarily due to currency headwinds. The strengthening of the US dollar against other major world currencies also pulled down the 4Q15 sales of PepsiCo by 6.8%. Leading energy drinks maker Monster Beverage (MNST) is expected to announce its 4Q15 results later this month. The company posted sales growth of 19% in 3Q15, driven by strong demand for energy drinks.

Keep reading this earnings overview series for an analysis of Dr Pepper Snapple’s earnings, volumes, price movement, margins, and its outlook for fiscal 2016.