How Investing in GATEX Could Impact Your Portfolio

GATEX could increase the exposure of an investor’s portfolio in the equity market. It has less volatility risk than the equity markets.

Nov. 20 2020, Updated 1:29 p.m. ET

Alternative fund’s benefits

Different alternative funds perform different investment goal-related functions. Some alternative funds can be used to reduce the overall volatility of a portfolio. Other alternative funds can boost a portfolio’s total return after tax. The Gateway Fund – Class A (GATEX) is an alternative mutual fund that could increase the exposure of an investor’s portfolio in the equity market. It has less volatility risk compared to equity markets. GATEX’s top holdings include stocks like Amazon (AMZN), JPMorgan Chase (JPM), Johnson & Johnson (JNJ), and Alphabet (GOOG). GATEX’s benchmark index is the S&P 500 Index (VFINX).

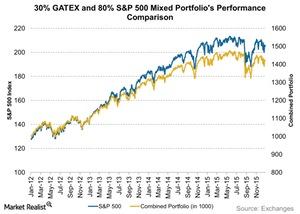

The above chart compares the return performance of a mixed portfolio consisting of 30% GATEX and 70% S&P 500 holdings with the return performance of the S&P 500 itself during a span of three years.

Reduced volatility, reduced returns

The S&P 500 Index performed better than GATEX. The three-year annualized return of the S&P 500 Index as of January 4, 2016, is 13.9%. GATEX’s return is 4.3%. However, GATEX isn’t as volatile as the S&P 500 Index. As a result, including GATEX in a portfolio could reduce the overall volatility risk. This would reduce the portfolio’s downside risk. Investing in GATEX resulted in a mixed portfolio. It gave reduced returns of 11%.

Conclusion

GATEX is an alternative mutual fund that uses a popular hedge fund strategy to achieve its investment objective of outperforming the S&P Index. It could reduce a portfolio’s volatility risk. The fund uses the market neutral hedge fund strategy to reduce the risk. It maintains a portfolio of common stocks mixed with short calls and long put index options. A mutual fund also provides exposure to the precious metals sector. An example of such a fund is the First Eagle Gold Fund – Class A (SGGDX). To learn more about SGGDX, read SGGDX: A Structural Analysis of the Alternative Mutual Fund.