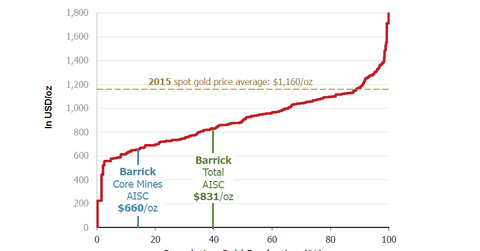

Barrick’s Focus on Costs Places It Favorably on Gold’s Cost Curve

Barrick Gold achieved all-in sustaining costs of $831 per ounce for 2015. This AISC was below the 40th percentile of the global industry cost curve.

March 1 2016, Updated 4:06 p.m. ET

Strong position on cost curve

Barrick Gold (ABX) achieved all-in sustaining costs (or AISC) of $831 per ounce in 2015. This was on the lower end of its cost guidance range of $830–$870 per ounce.

According to the company, this AISC was below the 40th percentile of the global industry cost curve. Its five core mines had lower AISC at $660 per ounce, which was below the 15th percentile of the cost curve.

Barrick’s costs were also lower than those of its nearest peers. Newmont Mining (NEM), Yamana Gold (AUY), and Kinross Gold (KGC) had AISC of $910, $842, and $975 per ounce, respectively, in 2015.

Strong focus on lowering costs

Barrick expects to produce ounces at significantly lower unit costs going forward. Its mid-point guidance of AISC for 2016 is $800 per ounce, while its outlooks for 2017 and 2018 are lower still at $765 per ounce and $750 per ounce, respectively.

Barrick aspires to achieve AISC of below $700 per ounce by 2019, which will be below the 25th percentile of the industry cost curve.

Drivers for lowering costs

Barrick divested many of its non-core assets, which had costs higher than the company’s average costs, in 2015. This was one of the major reasons for the company’s strong cost performance in 2015.

The company is strongly focused on lowering its AISC to achieve positive free cash flow even at a gold price level of $1,000 per ounce. Some of the factors that will contribute to lower AISC going forward are:

- Labor: Increasing underground face time, contractor reduction, and consolidation

- Energy and fuel: Energy efficient hauling methods and converting to renewable energy sources

- Maintenance: Improving maintenance planning and reducing breakdowns

- Plant and equipment: Automated trucking, improving shovel and truck equipment effectiveness

- Consumables: Improving road surfaces and reducing chemical use in process plants

Investors can gain exposure to the gold industry through gold-backed ETFs such as the SPDR Gold Trust (GLD). Kinross Gold accounts for 2.8% of the total holdings of the VanEck Vectors Gold Miners ETF (GDX), which provides exposure to senior and intermediate gold miners.