Why Is Apple So Concerned about Currency Fluctuations?

Last month, Apple (AAPL) declared its fiscal 1Q16 results, reporting revenues of $75.9 billion. Revenues rose 2% YoY (year-over-year) and 8% on a constant currency basis.

Feb. 19 2016, Published 11:36 a.m. ET

Apple’s fiscal 1Q16 growth is impressive

Last month, Apple (AAPL) declared its fiscal 1Q16 results, reporting revenues of $75.9 billion. Revenues rose 2% YoY (year-over-year) and 8% on a constant currency basis. Apple’s chief executive officer Tim Cook stated, “Our results are particularly impressive given the challenging global macroeconomic environment. We’re seeing extreme conditions unlike anything we’ve experienced before just about everywhere we look.”

Apple’s record revenue and strong operating performance led to an all-time quarterly net income record of $18.4 billion.

Record number of iPhones shipped in fiscal 1Q16

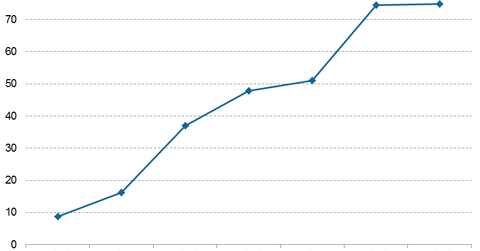

Apple sold 74.8 million iPhones in the December quarter. It represented an increase of 50% compared to fiscal 1Q14 and an increase of 400% compared to fiscal 1Q11. Apple’s major markets include Russia, Brazil, Japan (EWJ), China (FXI), Canada, Southeast Asia, Australia, the Eurozone, and Turkey. These markets have been impacted by weakening currencies and slowing economic growth.

Since the end of fiscal 2014, the euro and British pound have depreciated more than 10%. Other currencies such as the Canadian dollar, the Australian dollar, the Mexican peso, and the Turkish lira have fallen 20% or more. The Brazilian real is down more than 40%, and the Russian ruble has declined more than 50%.

Apple generates more than 65% of its revenues in overseas markets. So currency fluctuations have a significant impact on revenues. Revenues of other technology companies such as IBM (IBM), Electronic Arts (EA), and Google (GOOG) were also negatively impacted in the last few quarters due to currency headwinds.