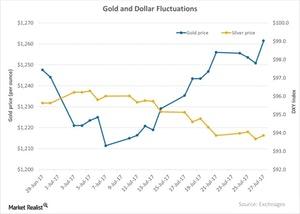

How the US Dollar Affected Gold

The US dollar has been on a downward swing over the past week.

Aug. 1 2017, Updated 9:12 a.m. ET

Dollar slump

Other currencies are strong

The dollar has fallen nearly 9% against a basket of foreign currencies on a year-to-date basis, which is mainly due to the uncertainty surrounding whether President Donald Trump’s economic agenda will get underway. The fall is also a result of the reduced chance the Fed will hike interest rates again this year.

The dollar index was trading close to its 13-month low on Wednesday, July 26. The euro has been strong and has been at its 23-month high over the past week. The Canadian dollar has also risen to almost a two-year high against the US dollar.