Understanding Qdoba Mexican Eats’ Franchisee Model

Since Jack in the Box’s acquisition of brand Qdoba Mexican Grill, now named Qdoba Mexican Eats, the brand has grown from a mere 85 restaurants to 661.

Jan. 20 2016, Updated 12:06 p.m. ET

Franchisee model

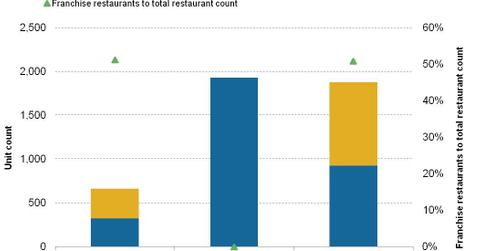

Since Jack in the Box’s (JACK) acquisition of brand Qdoba Mexican Grill, now named Qdoba Mexican Eats, the brand has grown from a mere 85 restaurants to 661. After restructuring in 2012, the company has been testing different concepts, pricing structures, and menu items. For greater control, the company is currently focused on company-owned restaurant unit growth. In the last five years, Qdoba’s company-owned restaurants have increased from 245 to 322, whereas franchisee-operated restaurants have decreased slightly from 339 to 338. From 2011 to 2015, the percentage of franchisee-owned restaurants fell from 58% to 51.2%.

Peer comparison

As of September 2015, Chipotle Mexican Grill (CMG) operated 1,931 locations. All of them are company-owned restaurants. Another competitor, Panera Bread (PNRA), operated 1,880 restaurants, with 955, or 50.8%, operated by franchisees.

Franchise agreements for Qdoba

Qdoba Mexican Eats’ franchise agreement requires franchisees to pay a fee of $30,000 for ten years and an extra $5,000 for a ten-year extension. The franchisee has to pay 5% of the gross sales as a royalty fee and 2% as a marketing fee. Also, franchisees are required to spend 1% of their revenue on local marketing programs. Non-traditional franchise agreements allow franchisees to pay $30,000 as an initial franchise fee and 6% of total sales as a royalty fee. The company also provides development agreements similar to those of the Jack in the Box brand.

The Consumer Discretionary Select Sector SPDR ETF (XLY), which invests about 10% of its portfolio in restaurant stocks, has 4.8% of its portfolio invested in McDonald’s (MCD).