Intermediate Gold Miners Fell in 2015 and Beyond

From the start of 2015 to January 8, 2016, the prices of gold (GLD) have fallen by 7% and the VanEck Vectors Gold Miners Index (GDX) has fallen by 23%.

Jan. 12 2016, Published 9:27 a.m. ET

Gold price performance

Gold prices had a tumultuous 2015. After getting a good start to the year—driven by strong demand from Asia, the Greek crisis, and the Swiss currency cap removal—gold prices started pulling back in April. Since then, the Fed’s rate hike decision was the most dominant factor affecting gold prices.

More recently, the Fed’s rate hike impacted gold prices somewhat negatively, but they were supported by an accommodative policy outlook. Starting in 2016, global economic tremors created by China and the growing unrest in the Middle East have been supporting gold prices.

Intermediate gold miners’ performance

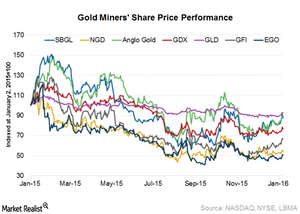

Gold stocks have also been in for a roller coaster ride along with gold prices. From the start of 2015 to January 8, 2016, gold prices (GLD) have fallen by 7% and the VanEck Vectors Gold Miners Index (GDX) has fallen by 23%. Intermediate gold miners have also fallen, led by Eldorado Gold (EGO) and New Gold (NGD). These two fell by 49% and 46%, respectively. Gold Fields (GFI), Sibanye Gold (SBGL), and AngloGold Ashanti (AU) gave returns of -33%, -13%, and -10%, respectively.

What we’ll cover in this series

In this series, we’ll discuss various factors such as cost reduction, production growth, reserve growth potential, leverage, financial health, analyst ratings, and valuation multiples. We’ll use five notable intermediate gold mining companies in our analysis. Investors can use this as a starting point to understand the companies that could outperform or underperform based on these factors in the current volatile gold price environment.

Major gold ETFs include the VanEck Vectors Gold Miners Index (GDX) and the SPDR Gold Trust (GLD). Investors can get gold exposure by investing in these ETFs. Agnico Eagle is one of the largest companies in the Gold Miners ETF (GDX), with total holdings of 5.5% in the fund’s portfolio.

We’ll start by looking at gold miners’ geographical exposure in the next part of this series.