Growth and Synergies Drive the Baxalta–Shire Merger

The Baxalta–Shire merger could create the top platform for rare diseases in the world. Baxalta brings Advate, a treatment for hemophilia, a rare blood disease.

Jan. 15 2016, Updated 9:06 a.m. ET

Growth and synergies drive the merger

The Baxalta–Shire merger could create the top platform for rare diseases in the world. Baxalta (BXLT) brings Advate, a treatment for the rare blood disease hemophilia. Shire (SHPG) is best known for Adderal, a treatment for attention deficit disorder. The market for rare diseases is expected to grow by 60% over the next five years.

Comments from management

Shire’s CEO Flemming Ørnskov said, “This proposed combination allows us to realize our vision of building the leading biotechnology company focused on rare diseases. Together, we will have leadership positions in multiple, high-value franchises and become the clear partner of choice in rare diseases. Our expanded portfolio and presence in more than 100 countries will drive our growth to over $20 billion in anticipated annual revenues by 2020. Our due diligence has reinforced our belief in the combination, and we look forward to welcoming Baxalta colleagues to a shared entrepreneurial, patient-driven culture.”

Additionally, Baxalta’s CEO Ludwig Hantson said, “Today’s announcement marks a new path forward for our organization and is a testament to the significant progress we have made in achieving our strategic business priorities. This transaction presents a unique opportunity for Baxalta shareholders, who will receive substantial immediate value as well as an ongoing stake in a combined global leader in rare diseases with strong growth prospects. We bring to Shire a strong portfolio and pipeline of market-leading products, high-quality manufacturing capabilities and a talented global workforce that places patients at the center of everything we do. The combined organization will be well positioned to accelerate innovation and deliver enhanced value for all stakeholders.”

Expected synergies and pro forma financials

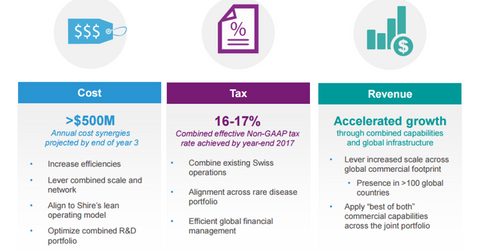

The deal is expected to yield annual cost synergies of $500 million, with the potential for revenue synergies as well. It will be accretive to non-GAAP[1. Generally accepted accounting principles] EPS (earnings per share) in 2017, the first full year after completion. Their tax rate could be about 16%–17%.

Other merger arbitrage resources

Other important merger spreads include the Cigna (CI) and Anthem (ANTM) deal, slated to close in the second half of 2015. For a primer on risk arbitrage investing, read Merger arbitrage must-knows: A key guide for investors.

Investors who are interested in trading in the healthcare sector could look at the S&P SPDR Healthcare ETF (XLV).