How Much Did Cal-Maine Return to Shareholders in Fiscal 2016?

Cal-Maine Foods has a dividend yield of 4.0% as of July 18, 2016. Management raised the dividend at a CAGR (compound annual growth rate) of 15.3% over five years.

July 25 2016, Updated 9:04 a.m. ET

Variable dividend policy

Cal-Maine Foods (CALM) has a variable dividend policy in place. In each quarter, when the company reports a net profit, it pays a cash dividend to shareholders in an amount equal to one-third of the quarterly income. The company doesn’t pay any dividend when no net profit is earned in any quarter. As a result, the company didn’t pay any dividend in fiscal 4Q16 because it reported a loss.

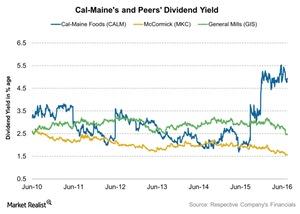

Dividend yield

Cal-Maine Foods has a dividend yield of 4.0% as of July 18, 2016. The company’s management raised the dividend at a CAGR (compound annual growth rate) of 15.3% over five years. For fiscal 2016, the company recorded the highest annual net income in its history of $316 million. It returned $105.6 million in dividends to its shareholders for fiscal 2016. In fiscal 2016, the company has paid $2.18 per share in dividends to shareholders—compared to $53.8 million, or $1.11 per share, in dividends paid in fiscal 2015.

The last dividend paid in 3Q16

The company announced a cash dividend of ~$0.44 per share for fiscal 3Q16 to holders of its common and Class A common stock. This dividend was paid on May 12, 2016, to shareholders of record as of April 27, 2016. The dividend declared was consistent with the company’s variable dividend policy.

The following are the dividend yields of its peers as of July 18:

- McCormick & Company (MKC) has a dividend yield of 1.6%.

- General Mills (GIS) has a dividend yield of 2.6%.

The iShares Morningstar Small Value ETF (JKL) and the SPDR Dow Jones Small Cap Growth ETF (SLYG) invest 0.28% and 0.43% in Cal-Maine.