Will Philip Morris’s 4Q16 Earnings Results Boost Its Stock Price?

Philip Morris International (PM), a US-based tobacco company, is set to announce its 4Q16 earnings on February 2, 2017, before the market opens.

Jan. 24 2017, Updated 12:19 p.m. ET

Philip Morris International

Philip Morris International (PM), a US-based tobacco company, is set to announce its 4Q16 earnings on February 2, 2017, before the market opens. The company’s product portfolio consists of brands such as Marlboro, Merit, Virginia Slims, Bond Street, Chesterfield, Next, and L&M. The company markets its products outside the United States.

Stock performance

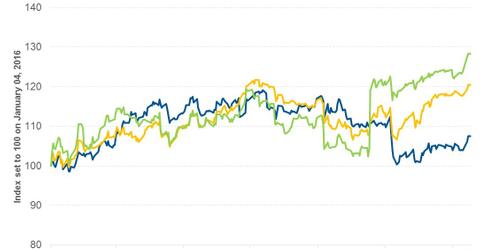

Since the announcement of its 3Q16 earnings on October 18, 3016, Philip Morris’s stock price has fallen 1%. Although the company’s 3Q16 earnings were better than expected, declining volume in the smokeable category, rising competition in the vapor category, and the strengthening of the US dollar has made investors skeptical of Philip Morris’s future earnings. The entire tobacco industry has been feeling the pressure of the declining smoking population, which, along the rise in the cost of sales, has contributed to the fall in Philip Morris’s stock price.

2016 stock performance

Despite the unfavorable exchange rate, declining volume, and competition from local players, Philip Morris returned 5.2% in 2016. The geographical expansion of its new IQOS, an electronically heated tobacco product, to select markets appears to have increased investor confidence, boosting its stock price. During the same period, peers Altria Group (MO) and Reynolds American (RAI) returned 20.5% and 28.3%, respectively. In comparison, the broader comparative index, the First Trust Morningstar Dividend Leaders Index ETF (FDL), returned 18.3%. FDL has invested 12.1% of its holdings in cigarette and tobacco companies.

Series overview

With 4Q16 results just around the corner, this series will focus on what you can expect from Philip Morris. We’ll cover analysts’ estimates for its revenue, operating margins, and EPS (earnings per share). We’ll also look at the company’s valuation multiple and expected stock price over the next 12 months. Let’s start with analysts’ expectations for Philip Morris’s 4Q16 revenue.