Bid-to-Cover Ratio Fell for 26-Week Treasury Bill Auction

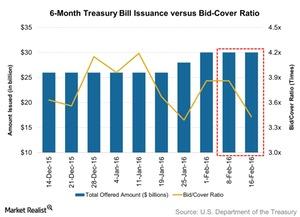

The U.S. Department of the Treasury held the weekly 26-week Treasury bill auction on February 16, 2016. T-bills totaling $30 billion were on offer.

Feb. 22 2016, Published 2:41 p.m. ET

26-week Treasury bill auction

The U.S. Department of the Treasury held the weekly 26-week Treasury bill (or T-bill) auction on February 16, 2016. T-bills totaling $30 billion were on offer, the same amount as in the previous three weeks.

The bid-to-cover ratio tanked 11.1% from the previous week to 3.4x. In 2015, the bid-to-cover ratio has averaged 4.0x. The ratio depicts overall demand for the auction.

Yield analysis

Treasury bills do not pay coupons. They are offered at a discount to face value. They are redeemable at par on maturity. The high discount rate for the February 16 auction came in at 0.41%—slightly lower than 0.42% in the previous week.

Market demand took a dive

Fundamental market demand nose-dived last week, from 62.6% a week prior to 41.0%. Accepted indirect bids fell to 34.9% week-over-week from 55.1% in the previous week. Indirect bids are bids from foreign central banks and depict international demand for the auction.

The percentage of direct bids nudged down to 6.1% week-over-week from 7.5% a week ago. Direct bids include bids from domestic money managers such as Wells Fargo (WFC) and State Street (STT).

Due to lower market demand, the share of primary dealer bids surged to 59.0% of the auction from 37.4% in the previous week. Primary dealers are a group of 22 authorized broker-dealers. They’re obligated to bid at US Treasury auctions and take up excess supply. They include companies such as Goldman Sachs (GS) and Citigroup Global Markets (C). A rise in the percentage of primary dealer bids indicates weak fundamental market demand.

Investment impact

Mutual funds such as the MFS Government Securities Fund Class A (MFGSX) and the Prudential Government Income Fund Class A (PGVAX) invest in T-bills. MFGSX was flat while PGVAX was up by 0.12% last week.