What’s on the Table with Kraft Heinz? Getting to Know the Company’s Product Offerings

Kraft Heinz operates more than 200 brands in nearly 200 countries. Its eight iconic brands contribute more than $1 billion in sales apiece to total revenue.

Jan. 2 2016, Updated 10:05 a.m. ET

Kraft Heinz’s product offerings

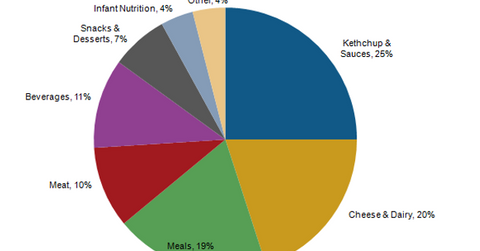

The Kraft Heinz Company (KHC) was formed on July 2, 2015, with the merger of the Kraft Foods Group and Heinz Company. The company manufactures and markets food and beverage products throughout the world. The chart below gives a breakdown of Kraft Heinz’s product portfolio.

Based on fiscal 2014 pro forma sales of $29.1 billion, ketchup and sauces represented 25% of the company’s total sales, followed by cheese and dairy, with a revenue contribution of 20%, and meals, with a revenue contribution of 19%.

Kraft Heinz’s iconic brands

Kraft Heinz operates more than 200 brands in nearly 200 countries. The company’s eight iconic brands have more than $1 billion in sales each and five brands contribute between $500 million and $1 billion apiece to the company’s total revenues.

The company’s major brands include the following:

- Kraft

- Heinz

- ABC

- Capri Sun

- Classico

- Jell-O

- Kool-Aid

- Lunchables

- Maxwell House

Kraft Heinz also has the following big-name brands in its stable:

- Ore-Ida

- Oscar Mayer

- Philadelphia

- Planters

- Plasmon

- Quero

- Weight Watchers

- Smart Ones

- Velveeta

Peer group comparisons

One of Kraft Heinz’s biggest competitors in the industry, Hain Celestial Group (HAIN), generates all of its revenues solely from natural and organic food. Nestlé SA (NSRGY), by comparison, generated its highest revenues from beverages, with 22.2% contribution in fiscal 2014, which for the company ended on December 31, 2014.

By contrast, Mondelēz International (MDLZ) generated its highest revenues from its biscuits business in fiscal 2014, which for the company ended on December 31, 2014, with a revenue contribution of 33.6%. Beverages contributed 16.6% of the company’s total revenues in fiscal 2014, whereas cheese and grocery contributed 8.8% ofMondelēz’s total revenues over the same period.

Kraft Heinz makes up 0.23% and 0.39% of the portfolio holdings of the iShares Core S&P 500 (IVV) and the iShares Russell 1000 Growth ETF (IWF), respectively. Consumer staples companies make up 9.8% and 11.1% of IVV’s portfolio and IWF’s portfolio, respectively.

Read the next part of this series for a closer analysis of Kraft Heinz’s segments.