Treasury Yield Curve Flattened after US Interest Rate Hike

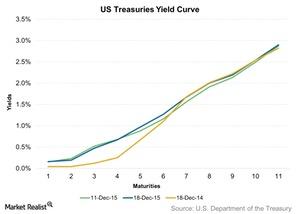

The US Treasury yield curve was flat for the week ended December 18, 2015, as short-term yields fell. Medium- to long-term yields rose after US interest rates rose by 25 basis points.

Dec. 21 2015, Published 3:51 p.m. ET

Secondary market

The US Treasury yield curve became flat for the week ended December 18, 2015, as short-term yields fell. Meanwhile, medium- to long-term yields rose after US interest rates rose by 25 basis points, a drop in oil prices, and a fall in equity markets.

However, the fall in yields was restricted to single digits while the rise in yields was in the range of three to 11 basis points. The yield on the benchmark ten-year Treasury note rose by six basis points week-over-week, ending at 2.19% on December 18.

Finally, the rate hike happened

The Federal Open Market Committee (or FOMC) unanimously voted on December 16, 2015, to raise interest rates by 25 basis points to a range of 25–50 basis points. The Fed indicated that the US economy is gradually strengthening, making it appropriate to raise rates. However, it noted that it will now closely watch inflation and employment levels before going ahead with another round of rate hikes.

The Federal Reserve chair, Janet Yellen, noted that “the pace of rate hikes would be gradual and dependent on incoming data.” The Fed’s dot plot chart that displays Fed officials’ predictions for future rate increases shows about four hikes next year.

Market participants are now speculating that the next rate hike may occur in July 2016, depending on how inflation and employment data pans out.

Foreigners sold record amount of US Treasury securities in October

According to data released by the Treasury Department on December 15, net foreign sales of Treasury bonds and notes were $55.1 billion during October. Foreigners sold a record net amount of US Treasuries in October due to an increased likelihood of liftoff in December and a decline in global market volatility.

China and Japan are the two top holders of US Treasury securities. China cut its Treasury holdings by $3.2 billion to $1.25 trillion while Japan slashed its Treasury holdings by $27.9 billion to $1.15 trillion in October.

Economic indicators

Treasury yields rose after the release of the Consumer Price Index (or CPI) data on December 15 ahead of the FOMC rate hike decision. Core CPI (CPI excluding food and energy prices) grew 2.0% on a year-over-year basis. The upbeat CPI data provided enough confidence for the Fed to go ahead with the long-awaited and widely expected rate hike.

Housing starts and building permits data was released on December 16. Housing starts rose 10.5% month-over-month to 1.17 million units, and new building permits rose by 11.0% month-over-month to 1.29 million units. The upbeat housing start and building permits data is positive news for homebuilders and home improvement companies PulteGroup Inc. (PHM), Lennar Corporation (LEN), D.R. Horton (DHI), and Home Depot (HD). Treasury yields rose after the data release.

Investment impact

The rise in long-term Treasury yields has a negative impact on mutual funds returns. Of the mutual funds that provide exposure to Treasuries, the Dreyfus US Treasury Long-Term Fund’s (DRGBX) week-over-week return was down by 0.41%. The Wasatch-Hoisington US Treasury Fund’s (WHOSX) weekly return fell by 0.49%.

In the next article, we will look at the five-year TIPS auction.