What Post Properties’ Higher-than-Average EV-to-EBITDA Multiple Means

Post Properties’ EV-to-EBITDA ratio is in line with its historical valuation, ranging between 12.2x–25.5x, with a current EV-to-EBITDA ratio of ~21.7x.

Dec. 8 2015, Updated 10:05 a.m. ET

Post Properties’ EV-to-EBITDA ratio

EV (enterprise value)-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) multiple is widely used in the valuation of real estate companies. EV represents the market value of equity and debt, minus cash and cash equivalents. A company’s EV-to-EBITDA ratio evaluates the worth of the entire company and not just the equity portion.

Why the EV-to-EBITDA multiple is preferred

Companies that raise debt in order to fund operations will likely have lower PE (price-to-earnings) ratios than companies that raise a similar amount of equity, even though the two companies might have equivalent enterprise values. A company with a lower PE ratio may look cheaper than a company with higher PE ratio.

This means that, in the case of PE multiple, a company with a substantial amount of debt may look cheaper, whereas a company with less debt and a higher equity portion may look pricey. The REIT (real estate investment trust) industry is a capital-intensive business, and most REITs tend to raise a lot of debt in order to fund their operations. Thus, EV-to-EBITDA becomes an additional tool for valuing REITs, along with price-to-FFO multiples.

Post Properties’ EV-to-EBITDA multiple

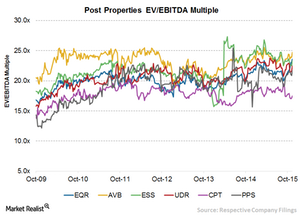

A closer look at Post Properties’ (PPS) EV-to-EBITDA multiple shows that it is in line with its historical valuation. Over the last six years, Post Properties’ EV-to-EBITDA ratio ranged between 12.2–25.5x, with a current EV-to-EBITDA multiple of around 21.7x. Post Properties recorded its highest EV-to-EBITDA multiple in June 2014, whereas its lowest multiple was in November 2009. The current industry average EV-to-EBITDA multiple is 20.8x.

Peer group comparisons

A peer group comparison shows that Post Properties’ EV-to-EBITDA multiple is lower than some of its close competitors and higher than others. For example, AvalonBay Communities (AVB) was trading at an EV-to-EBITDA multiple of 24.7x as of November 27.

By comparison, Equity Residential (EQR) was trading at an EV-to-EBITDA multiple of 23.6x, and Essex Property Trust (ESS) was trading at an EV-to-EBITDA multiple of 23.3x. Among Post Properties’ other major competitors, Camden Property Trust (CPT) was trading at the low EV-to-EBITDA multiple of 17.5x as of November 27.

The iShares US Real Estate ETF (IYR) invests 0.39% of its portfolio in Post Properties.

In the next and final part of this series, we’ll explore the prospects of investing in Post Properties through ETFs.