Sizing up Kohl’s Relative Valuation versus Its Peer Group

As of December 15, Kohl’s was trading at a forward PE multiple of 10.2x. Kohl’s is trading at a premium valuation compared to Macy’s and Dillard’s.

Jan. 7 2016, Updated 12:04 p.m. ET

Kohl’s relative valuation

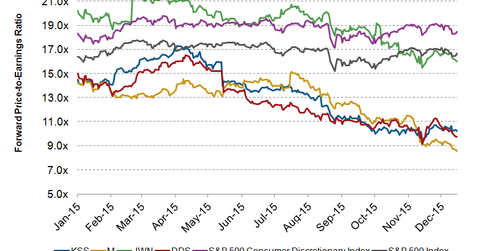

PE (price-to-earnings) valuation multiples for major department stores have declined since the beginning of 2015, and this reflects the sluggishness in the industry and the cautious outlook given the uncertain retail environment.

As of December 15, Kohl’s Corporation (KSS) was trading at a forward PE multiple of 10.2x. Kohl’s is trading at a premium valuation compared to Macy’s (M) and Dillard’s (DDS) but lower than Nordstrom (JWN). As of December 15, Macy’s, Dillard’s, and Nordstrom were trading at forward PE valuations of 8.6x, 9.8x, and 16.0x, respectively.

Kohl’s fiscal 2015 earnings expectations

As of December 15, Kohl’s valuation has declined by 29.6% since the start of the year. Analysts expect the company’s adjusted EPS (earnings per share) in fiscal 2015 ending January 30, 2016, to come in at $4.31, which would reflect about a 2% growth compared to fiscal 2014.

In February 2015, Kohl’s stated that it expects its fiscal 2015 diluted EPS to come in the $4.40 to $4.60 range. In an update provided in August 2015, the company stated that it expects its fiscal 2015 EPS guidance to come in the lower range of its previous guidance—that is, $4.40—due to the impact of loss on extinguishment of debt.

Peer valuations and earnings expectations

The changes in valuation and earnings expectations for Kohl’s peers are as follows:

- Macy’s PE valuation has declined by 39.5% since the start of 2015. Macy’s has delivered a dismal performance in the first three quarters of fiscal 2015, with its sales declining in each of the three quarters. Macy’s lower valuation compared to Kohl’s is justified by lower expectations for the company’s earnings. Analysts expect Macy’s fiscal 2015 adjusted EPS to decline by 4% in fiscal 2015.

- As of December 15, Dillard’s forward PE valuation has declined by 35% since the start of the year. Analysts expect Dillard’s fiscal 2015 adjusted EPS to come in at $7.12, reflecting a 9% decline compared to the prior year.

- Nordstrom’s PE valuation multiple has dropped by 20.7% on a YTD (year-to-date) basis. Analysts expect Nordstrom adjusted EPS in fiscal 2015 to decline by 8%. Nordstrom’s earnings are getting affected by the company’s growth initiatives, including its expansion in the Canadian market. Nordstrom’s sales growth continues to be better than its peer group.

Kohl’s compared to the S&P 500

As of December 15, Kohl’s was trading at a lower valuation compared to the S&P 500 Consumer Discretionary Index, which has a forward PE valuation of 18.5x, and S&P 500 Index, which has a forward PE valuation of 16.7x.

Kohl’s makes up 1% of the First Trust Consumer Discretionary AlphaDEX Fund (FXD), which tracks the StrataQuant Consumer Discretionary Index.

In the next and final two parts of this series, we’ll do a crucial SWOT (strengths, weaknesses, opportunities, and threats) analysis of Kohl’s.