Papa John’s Franchising and Quality Centers—the Foremost Piece of Company Pie

To maintain the quality and consistency of products, Papa John’s has QC (quality control) centers that supply ingredients to its restaurants.

Dec. 19 2015, Updated 3:04 a.m. ET

Business model

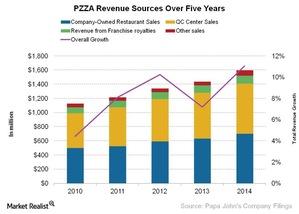

To maintain the quality and consistency of products at Papa John’s International (PZZA), CEO and founder John H. Schnatter has built commissaries, or QC (quality control) centers, that supply dough, spices, and tomato sauce to its restaurants. Later in 1999, the company implemented a strategy to acquire franchisees to maintain a mix of 25% corporate-owned restaurants and 75% franchised restaurants. Revenues from the company-owned restaurants, the QC center sales, and the franchise fees and royalties collected from franchise owners, then, came to form the three main sources of revenues for Papa John’s.

What’s going on in Papa John’s QC centers?

To maintain the quality and consistency of its products across the US, all restaurants are required to buy dough and tomato sauce from Papa John’s QC centers. The QC centers also deliver ingredients and toppings to the individual restaurants twice weekly. In 2014, sales from QC centers made up 44% of total revenues at Papa John’s.

Revenues from QC centers increase with any increase in restaurant sales as well as with any increase in a number of restaurants. Revenue from QC centers thus increased by 12.7%, 8.9%, 7.9%, and 9.3 in 2011, 2012, 2013, and 2014, respectively.

Company-owned restaurants

Of the 735 company-operated restaurants that Papa John’s operates, 686 are in North America, and remaining 49 are in international markets. In 2014, the revenue from company-owned restaurants made up 44.1% of total revenues. The revenue from the company-owned restaurants grew by 4.6%, 12.6%, 7.2%, and 10.6% in 2011, 2012, 2013, and 2014, respectively.

By comparison, Domino’s Pizza’s (DPZ) revenues from company-owned restaurants increased by 3.2% in 2014. However, in the same year, revenues from the company-owned restaurants of McDonald’s Corporation (MCD) decreased by 3.7%, and Pizza Hut, a subsidiary of YUM! Brands (YUM), also saw its revenues decrease by 0.3% over the same period.

Franchise royalties and development fees

Papa John’s charges 5% of total sales as royalties from its franchisees. This means that its revenues increase with franchise sales as well as with any increase in the number of its restaurants. Revenues from franchise and development fees increase with increases in the number of franchisees. In 2014, this segment contributed 7.3% of the total revenues it generated. The revenues from this segment grew by 8.3%, 9.9%, 4.9%, and 10.6% in 2011, 2012, 2013, and 2014, respectively.

From 2010 to 2014, Papa John’s overall revenues have increased by 42%, with a compounded annual growth rate of 7.8%. Notably, the Consumer Discretionary Select Sector SPDR Fund (XLY) has 1.5% of its portfolio invested in YUM! Brands (YUM) and 4% invested in McDonald’s Corporation (MCD). Papa John’s International (PZZA) makes up 2.2% of the PowerShares Dynamic Leisure and Entertainment Portfolio (PEJ) and approximately 2.3% of the PowerShares Dynamic Food & Beverage Portfolio (PBJ).

Continue to the next part of this series for a look at Papa John’s franchise model.