Why Operating Margin Expansion Might Be a Tough Task for Macy’s

Macy’s (M) operating margin in 3Q15 declined to 4.4% from 6.8% in the comparable quarter of the previous year. The company’s 3Q15 operating margin was also lower than its peers.

Nov. 20 2020, Updated 3:57 p.m. ET

Operating margin compared to peers

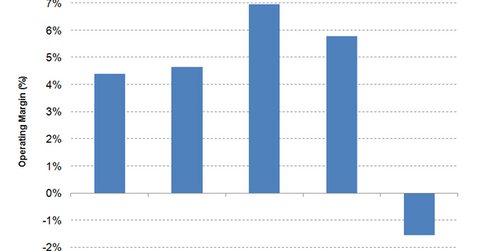

Macy’s (M) operating margin in 3Q15 declined to 4.4% from 6.8% in the comparable quarter of the previous year. The company’s 3Q15 operating margin was also lower than peers Nordstrom (JWN), Kohl’s (KSS), and Dillard’s (DDS), which reported operating margins of 4.7%, 6.9%, and 5.8%, respectively. The 3Q15 operating margin of JCPenney (JCP) continued to be negative but was better than the comparable quarter of the previous year.

Decline in operating margin

Macy’s gross margin in 3Q15 improved by 60 basis points to 39.8% due to higher merchandise margins and a decline in low-margin-third-party sales. However, the company’s operating margin declined due to a $111 million impairment charge related to planned store closures and growth initiatives. These initiatives included the expansion of its Bluemercury business, off-price Macy’s Backstage stores, online expansion, and its entry into the Chinese market through Alibaba’s (BABA) Tmall Group.

Pressure on margins likely to continue

Macy’s margins in 4Q15 might be under pressure, as the company will have to take markdowns on higher inventory that the company entered the quarter with. Also, Macy’s operating margin in 4Q15 is likely to be adversely impacted by investments in the following growth initiatives:

- Macy’s Backstage and Bluemercury

- shift in the timing of marketing expense from 3Q15 to 4Q15

- lower asset gains compared to the fourth quarter of the previous year

However, Macy’s operating margin is likely to benefit from a $250 million gain associated with the sale of its real estate in downtown Brooklyn. The iShares Russell 1000 Growth ETF (IWF) has 0.1% exposure to Macy’s.

Initiatives to improve margin

Macy’s is planning to improve its margins by closing unprofitable stores, starting with a planned closure of 35–40 stores in early 2016. The company also plans to tighten its capital spending. Macy’s plans to reduce its selling, general, and administrative expenses by $500 million on an annual basis by 2016. The company expects part of the reduction to come from a greater use of technology.