Mapping Abbott Laboratories’ Geographic Strategy

Abbott Laboratories is a global healthcare company that sees 70% of its total revenues generated in markets outside the United States.

Dec. 22 2015, Updated 8:06 a.m. ET

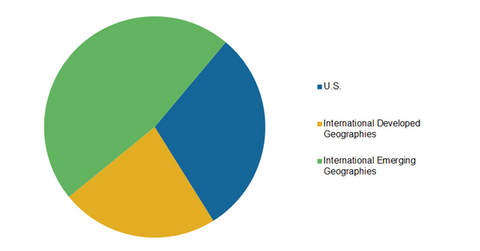

A geographical overview of Abbott Laboratories

Abbott Laboratories (ABT) is a global healthcare company that sees 70% of its total revenues generated in markets outside the United States. The company is well-distributed across the world’s largest markets as the revenues generated from 11 of the largest medical technology markets contribute to 64% of the total sales of the company.

Abbott Laboratories has strategically expanded across geographies, taking into account both globally and locally aligned needs and preferences. With growing demand, Abbott has set up various manufacturing and research and development facilities over the past few years, and recently, it has added a new vaccine facility in the Netherlands, an optics facility in Malaysia, and nutrition plants in China, India, and the United States.

Emerging markets growth potential

Expansion across the emerging markets continue to be the key growth strategy of Abbott Laboratories. As the growth in the developed markets is slowing down and—for certain medical device segments—becoming stagnant, emerging markets have grown to be the primary growth drivers.

In 2014, the company witnessed an operational sales growth of 12.5% from emerging markets. Since then, healthcare spending as a percentage of GDP is still very low in these economies, and there has been an immense growth potential for the medical device companies to further expand these business markets.

With the sale of the developed markets branded generics pharmaceuticals business to Mylan in 2015, Abbott’s established pharmaceutical business segment have become entirely focused on emerging markets.

Abbott’s competitors and ETF exposure

Some of the other companies with the emerging markets expansion as the key growth strategy are Johnson & Johnson (JNJ), Medtronic (MDT), and Becton Dickinson and Company (BDX).

Investors seeking participation in the future growth potential of the Abbot Laboratories (ABT) can invest in the Guggenheim S&P 500 Equal Weight Health Care ETF (RYH), which has an exposure of 1.9% to ABT. Investors can also gain exposure to ABT through the iShares US Healthcare ETF (IYH). ABT accounts for 2.4% of IYH’s total holdings.

Continue to the next part of this series for a discussion of Abbott Laboratories’ acquisitions and divestments.