Gauging Medtronic’s Geographic Strategy in 2015

Medtronic’s US market YoY growth rate was 22% in 2015, compared to a 2% growth in 2014, whereas its emerging markets have grown by 23% in 2015.

Dec. 4 2015, Updated 1:06 p.m. ET

Medtronic’s geographic strategy

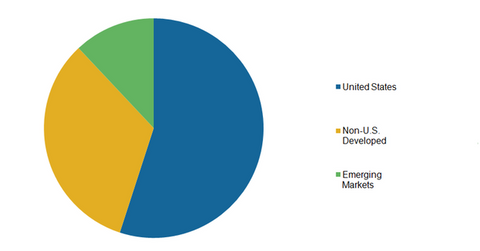

One of the primary three strategies of Medtronic (MDT) is globalization, which drives its growth and expansion. Although Medtronic has already been successful in expanding its business across the world, the United States is still its largest market, representing 56% of the company’s total revenues in 2015. Emerging market and non-US developed markets constitute 13% and 31%, respectively, of the company’s market share.

Emerging market opportunities and risks

Although the US accounts for the largest market share of Medtronic’s devices and products, emerging markets have been witnessing a higher growth rate and have begun to provide even more opportunities for growth. The US market YoY (year-over-year) growth rate was 22% in 2015, compared to a 2% growth in 2014, whereas emerging markets have grown by 23% in 2015, compared to 13% in 2014.

However, with significant exposure to international markets, Medtronic becomes vulnerable to fluctuations of currency rates and economic and political stability in countries outside of the US.

Medtronic’s mergers and acquisitions

Medtronic has been involved in a number of acquisitions that have resulted in an expanded market reach of the company. Its acquisition of Covidien was one of the biggest deals in the industry and likewise helped Medtronic expand its reach, mainly to emerging markets. As a result of the deal, the company’s Latin America and Middle East markets have almost doubled in size in 2015.

Other major players in the industry, including Johnson & Johnson (JNJ), Becton Dickinson and Company (BDX), and Abbott Laboratories (ABT), have also adopted this same inorganic growth strategy for expansion into new geographical markets.

For diversified exposure to Medtronic, investors can invest in the Health Care Select Sector SPDR Fund (XLV), which has an exposure of approximately 4% to the company.

Now let’s take a closer look at the big Medtronic-Covidien Deal.