Established Pharmaceuticals Segment of Abbott Laboratories

Abbott’s Established Pharmaceuticals segment is a consumer-oriented segment with a consumer mix of around 75% self-pay consumers and 25% third-party payers.

Dec. 24 2015, Updated 2:05 p.m. ET

Established Pharmaceuticals segment overview

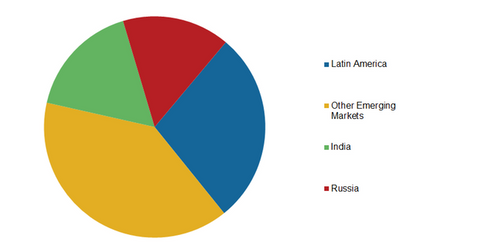

Abbott Laboratories (ABT) sold its developed markets branded generics pharmaceuticals business to Mylan, a global pharmaceutical company registered in the Netherlands, in a deal that completed on February 27, 2015. After the sale, Abbott’s Established Pharmaceuticals segment operated entirely in emerging markets.

The company continues to focus on an emerging markets penetration strategy and has entered various mergers and acquisitions deals, including the acquisition of CFR Pharmaceuticals, a Chilean pharmaceutical company, which almost doubled the company presence in Latin America.

Abbott’s Established Pharmaceuticals segment is mainly a consumer-oriented product segment that has a consumer mix of around 75% self-pay consumers and only 25% third-party payers. Thus, these products are generally sold directly to wholesalers, distributors, independent retailers, and pharmacies and aims to provide healthcare to the people at lower costs.

Abbott has six key areas in which it has major operations and strong brand recognition:

- gastroenterology

- women’s health

- cardio-metabolic

- pain and central nervous system

- respiratory anti-infectives

- influenza vaccines

Established Pharmaceuticals’ key products

Abbott has a range of more than 300 generics brands with global or local brand recognition. Some of the leading products in this segment include the following:

- Creon, a product containing a digestive enzyme that helps improve food digestion in humans

- Klacid, used to treat bacterial infections

- Duphaston, used to treat conditions such as menstrual disorders and abnormal uterine bleeding that arise because of lack of progesterone

Abbott’s competitors and ETF exposure

Some of the major competitors of Abbott Laboratories are Johnson & Johnson (JNJ), GE Healthcare, Boston Scientific Corporation (BSX) and Medtronic (MDT).

To gain exposure to Abbott Laboratories (ABT) without investing directly in the company, you can invest in the iShares US Medical Devices ETF (IHI), which has an allocation of around 10.5% of Abbott Laboratories. Investors can also gain exposure to ABT in the ETF iShares Global Healthcare ETF (IXJ). It accounts for 1.7% of IXJ’s total holdings.

Now let’s check out Abbott Laboratories’ Medical Device segment.