The Correlation of Chevron’s Stock to Oil and Natural Gas Prices

The integrated energy model provides Chevron’s insulation from oil and natural gas price volatility. This is reflected in the results of the correlation test.

Jan. 1 2016, Updated 1:05 p.m. ET

What’s the correlation coefficient?

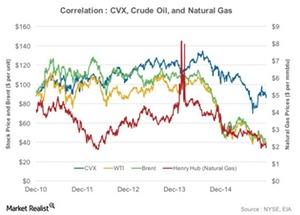

In this series, we have analyzed Chevron’s (CVX) stock movements, business segments, leverage, cash flows, and valuations. In this concluding part, we’ll test the correlation between CVX’s stock performance, crude oil, and natural gas prices. The correlation coefficient shows the relationship between two variables. A correlation coefficient value of zero to one shows a positive correlation, zero states no correlation, and negative one to zero shows an inverse correlation. For the past five years, we have considered the price history of CVX, Brent, WTI[1. West Texas Intermediate], and Henry Hub natural gas prices.

Chevron and oil price

The integrated energy model provides Chevron’s business insulation—not immunization—from oil and natural gas price volatility. This is reflected in the results of the correlation test. The correlation coefficients of CVX as compared to WTI, Brent, and Henry Hub natural gas prices stand at 0.59, 0.48, and 0.41, respectively. This means that around half of the movement in Chevron’s stock price can be explained by changes in oil and natural gas prices.

The situation remains the same for Chevron’s peer ExxonMobil (XOM). The correlation of XOM and Brent is even lower, standing at 0.22. However, other integrated energy players like BP (BP) and Royal Dutch Shell (RDS.A) show a higher correlation to Brent. The two stand at 0.62 and 0.70, respectively.

When we analyze a standalone upstream or downstream company, it’s observed that the correlation to oil’s price is even stronger than that of an integrated energy company’s correlation. A case in point is Valero Energy (VLO), a refiner that has a negative 0.71 correlation with Brent. This shows that the stock prices of refiners have moved inversely as compared to oil prices.

The iShares Russell 1000 Value ETF (IWD) has ~12% exposure to the energy sector stocks.