Why Abbott Laboratories Is a Leader in Nutritional Products

Abbott Laboratories’ Nutritional Products segment is the company’s leading segment, growing at a fast pace, with rapidly increasing margins and revenues.

April 22 2016, Updated 1:43 a.m. ET

Nutritional Products segment overview

Abbott Laboratories’ (ABT) Nutritional Products segment is the company’s leading segment and is growing at a fast pace, with rapidly increasing margins and revenues. Factors such as increasing rate of lifestyle diseases, aging population, and the rise of the middle class in emerging markets are driving the growth of Abbott’s worldwide nutritional products business.

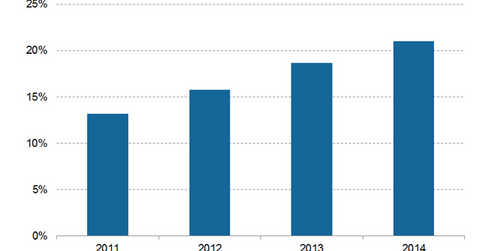

The operating margins of this segment have also witnessed a significant improvement over the years, rising from 13.2% in 2011 to 21% in 2014, due to the implementation of cost containment measures and operational efficiencies.

Nutritional Products’ growth strategies

The Nutritional Products segment of Abbott Laboratories has largely grown through emerging market expansion and new product development—70 being the average annual product launches over the past several years. In 2014, as part of the expansion initiatives of the company, Abbott established its manufacturing plants in China, India, and the United States and an R&D (research and development) center in China. The company also plans to develop a dairy farm hub in China in partnership with the world’s largest dairy cooperative, Fonterra.

Nutritional Products’ key products

Abbott Laboratories is the leader in adult nutritional products across the world and in pediatric nutritional products in the US, which account for around 45% and 55%, respectively, of the total revenues of Abbott’s Nutritional Products segment. Product brands catering to adult nutritional products segment includes Ensure, whereas Similac and Pediasure are the major product brands in the segment’s pediatric nutritional products category.

Abbott’s competitors and ETF exposure

Some of the competitors of Abbott Laboratories in the United States include Johnson & Johnson (JNJ), Medtronic (MDT), and Thermo Fisher Scientific (TMO).

For diversified exposure to Abbott Laboratories (ABT), investors can invest in the iShares Global Healthcare ETF (IXJ), which has 1.7% of its total holdings in ABT. Investors can also invest in the iShares US Healthcare ETF (IYH) and get exposure to ABT, which accounts for 2.4% of IYH’s total holdings.

Now let’s look at Abbott Laboratories’ diagnostic products segment.