2015 Has Been Hard on Mining Companies

2015 has been tough for miners, especially due to the price rout in the commodities market. The commodities market has fallen about 24.3% since the start of the year.

Dec. 17 2015, Published 4:39 p.m. ET

Miners’ carnage

2015 has been tough for miners, especially due to the price rout in the commodities market. The commodities market, which is tracked by the S&P GSCI (Goldman Sachs Commodity Index), has fallen about 24.3% since the start of the year. The drop in the commodities is also visible among the precious metals and other base metals. The mining industry’s performance is reflected by the VanEck Vectors Gold Miners ETF (GDX) and the SPDR S&P Metals and Mining ETF (XME), which have plunged by a whopping 21.8% and 50.6%, respectively, on a year-to-date basis.

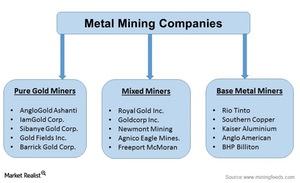

Pure versus diversified

The miners include pure gold mining firms, whose core business is extracting gold. However, a few of these companies may have additional assets. Companies like Gold Fields (GFI) and IamGold (IAG) are a few of the pure gold miners. The enterprises that are termed as mixed miners include those who mine precious metals as well as other base metals like copper, aluminum, and iron ore. Mining giant Newmont Mining (NEM) is primarily into gold and copper mining.

There are also a few companies whose core business is silver like Pan American Silver (PAAS), but they also mine other base metals. However, companies like Southern Copper (SCCO) and Rio Tinto (RIO) are purely into the base metals mining business. GFI, IAG, NEM, and PAAS together contribute 11.8% to the VanEck Vectors Gold Miners ETF (GDX).

In the rest of this series, we will focus on the comparative performance of the different mining categories.