How the Threat of War Affects Gold Prices

Gold’s safe haven appeal might lead investors to gold and other precious metals in terms of heightened geopolitical tensions and war.

Dec. 1 2015, Updated 10:07 a.m. ET

Gold’s safe haven appeal

Gold’s safe haven appeal might lead investors to gold and other precious metals in terms of heightened geopolitical tensions and war. Not only are other asset prices affected immediately in the event of war or even the threat of it, but wars also mean excessive money printing and accelerated government spending. It’s no surprise, then, if investors turn their attention to gold and other precious metals. We’ll see how gold has reacted to the rumors of a war or to a run-up to war.

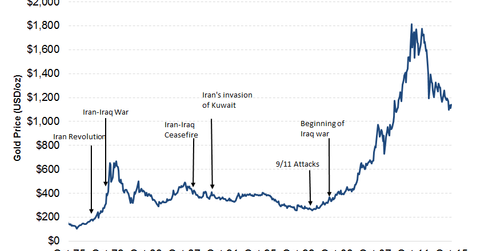

Upheavals during the 1970s

The late 1970s saw many upheavals, including the Iranian Revolution in 1978, the Iran-Iraq war in 1979, the Soviet Union’s invasion of Afghanistan in December 1979, and the Iranian hostage crisis in 1979. As you can see from the graph above, this period saw heightened activity in gold prices. Gold prices rose 23% in 1977, 37% in 1978, and an incredible 126% in 1979.

Other wars

During the first Gulf War, when Iraq invaded Kuwait in 1990, gold prices soared again. But soon after, gold returned to pre-war levels as talks of war continued. However, soon after the war was over, gold prices continued to soften, and by the end of 1991, they had reached almost the level they were at pre-invasion. After that, gold continued its downward trend as disinflation took hold.

After September 11, 2001, attack on the United States, gold prices surged. This move was followed by the US invasion of Iraq in 2003. This also resulted in an uptrend in gold prices. However, after a degree of confidence built up that the war would be short and successful, gold reverted to its pre-war value.

Even in 2014, when rumors started that the United States could intervene in Syria, gold prices reacted strongly. Recently, US military leaders have also warned against a bigger war with ISIS.

The situation in Europe already seems to be getting out of control. In Austria, for example, gun sales are at record levels. People are arming themselves as protection against any potential attack following an influx of refugees into Europe. If the outlook remains more or less the same, people might shift some of their portfolios toward gold and other precious metals, which might support precious metals in the medium term.

This would also support ETFs such as the VanEck Vectors Gold Miners ETF (GDX). Price changes in gold can also significantly affect stocks such as Sibanye Gold (SBGL), Agnico-Eagle Mines (AEM), Primero Mining (PPP), and Randgold Resources (GOLD). These four stocks make up 12.9% of GDX.