Kellogg’s Acquisitions and Their Benefits

The price of Kellogg’s acquisition of Diamond Foods is expected to reach over $1.5 billion, and Kellogg could offer the company between $35 and $40 per share.

Nov. 10 2015, Updated 5:04 p.m. ET

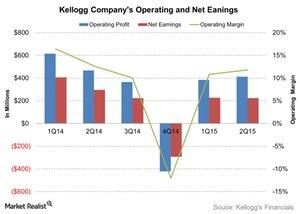

Effect of acquisitions on margins

So far this year, Kellogg Company (K) has had some acquisitions that it expected would benefit its operating profit and net earnings in fiscal 2015. These acquisitions include Mass Food Group and BiscoMisr, and Kellogg is planning an upcoming acquisition of Diamond Foods. We’ll review the details of these acquisitions in this article. Kellogg’s peers in the industry include Mead Johnson Nutrition Company (MJN), McCormick & Company (MKC), and Keurig Green Mountain (GMCR). They reported operating margins of 23.1%, 12%, and 16.6%, respectively, in their last quarter. The Vanguard Mid-Cap Growth ETF (VOT) invests 0.53% of its portfolio in the GMCR stock.

Kellogg in talks to acquire Diamond Foods

Kellogg is in advanced talks with snack maker Diamond Foods (DMND) regarding an acquisition of the company, which placed itself up for auction earlier this year. The price of the deal is expected to reach over $1.5 billion, and Kellogg could offer Diamond Foods between $35 and $40 per share. The deal with Diamond Foods is expected to help Kellogg transition away from cereal and further into snack foods, since the breakfast cereal market has been struggling lately.

Acquisition of Mass Food Group

On September 28, the company announced that it has acquired Egypt’s leading cereal company, Mass Food Group. This acquisition is in line with the company’s emerging market growth strategy. The company expects that the combination of Mass Food Group’s manufacturing capabilities, established local brands, and sales and distribution infrastructure, coupled with Kellogg’s product innovation, international sales knowledge, iconic brands, and marketing expertise, will help unlock the growth potential of the cereal category in the key markets of Egypt and North Africa.

The company has agreed to pay ~$50 million for Mass Food Group and is financing the transaction with international cash on hand. However, due to the size of Mass Food Group’s annual sales, the transaction is not expected to have a material impact on Kellogg’s annual operating profit and net earnings in 2015.

Other acquisitions in fiscal 2015

Earlier this year, Kellogg acquired BiscoMisr, Egypt’s leading packaged biscuit company. In mid-September, Kellogg Company also announced a joint venture with Tolaram Africa to develop snacks and breakfast foods for the West African market. Also, Kellogg acquired 50% of Multipro, a premier sales and distribution company in Nigeria and Ghana. We’ll see the effects of these acquisitions and ventures in the upcoming third quarter results.