Why Aren’t BHP and RIO Cutting Copper Production?

While major mining companies like Freeport-McMoRan and Glencore are declaring copper production cuts, BHP Billiton says it is reluctant to decrease its copper production.

Nov. 4 2015, Published 12:24 p.m. ET

Diversification of BHP Billiton’s assets

Even though huge production cuts were declared by its peers, Freeport-McMoRan (FCX), Glencore (GLEN), Anglo American (AAUKY), BHP Billiton (BHP), and Rio Tinto (RIO) are reluctant to cut back their copper production.

BHP Billiton believes low cost assets will support the company

While major mining companies like Freeport-McMoRan and Glencore are declaring copper production cuts, BHP Billiton says it is reluctant to decrease its copper production, as it doesn’t believe that it will lead to higher commodity prices. According to BHP’s marketing head, Arnoud Balhuizen, unlike its copper mining peers, BHP’s mines are generating cash.

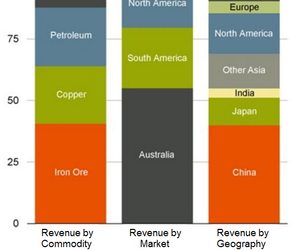

BHP is confident that its well-diversified, low-cost assets will keep it strong in the market regardless of falling copper prices. As a part of BHP’s strategy, it maintains assets diversified by market, geography, and commodity. BHP states that it has been using the same strategy for the past decade and it enabled the company to stay strong throughout many economic and commodity cycles.

Rio Tinto doesn’t want to lose market share

Rio Tinto announced that it has no plans to decrease its copper production and lose market share to its higher cost rivals. The head of copper and coal at Rio Tinto, Jean-Sebastien Jacques, said Rio would not decrease its copper production even though present copper prices don’t reflect “fundamentals.”

Rio Tinto is ready to fill the supply void created by Glencore and Freeport. Rio Tinto and BHP are ramping up the production of their commodities. By using their low-cost production to their competitive advantage, Rio and BHP have a good opportunity to increase their market share. Rio Tinto is expanding its Oyu Tolgoi copper mine located in Mongolia. According to its chief development officer, Craig Kinnell, Rio wants to lock in around $4.2 billion in financing by November. This mine expansion will extend its lifespan past 2100 and make 80% of its resources available. This makes Oyu Tolgoi the third largest copper mine in the world.

The slump in copper prices forced many miners to cut copper production. The SPDR S&P Metals & Mining ETF (XME) has fallen by 43% since the beginning of 2015.