An Analysis of Apache’s Free Cash Flow Trends

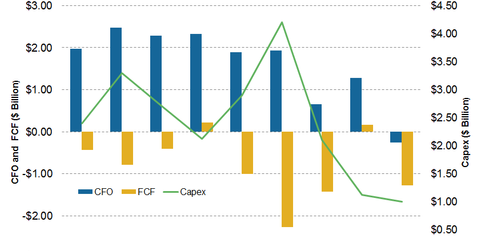

Apache’s free cash flow has been mostly negative in the past nine quarters. In 2Q15, it reported FCF of $157 million despite weakness in commodity prices.

Nov. 30 2015, Updated 8:06 a.m. ET

Apache’s cash flows

In this part of the series, we’ll be looking at Apache’s cash flows. In 3Q15, Apache reported a negative operating cash flow (or CFO) of $265 million. This was primarily due to lower revenues reported in the same period.

APA’s 3Q15 revenue came in at ~$1.5 billion, down ~57% compared to $3.4 billion recorded in 3Q14. Its year-to-date (or YTD) revenue was $5.1 billion compared to $10.1 billion recorded in the first nine months of 2014, a reduction of ~50%.

Apache’s free cash flow trends

Apache’s free cash flow (or FCF), which is operating cash flow less capital expenditure, has mostly remained negative in the past nine quarters as the chart above notes. However, in 2Q15, APA reported positive FCF of $157 million despite weakness in commodity prices.

Its 3Q15 FCF of negative ~$1.3 billion fell along with its CFO, which was hit by lower revenues on the back of lower realized prices. APA’s peers Hess (HES), Concho Resources (CXO), and Marathon Oil (MRO) reported FCFs of negative $681 million, $432 million, and $460 million, respectively, in 3Q15. All these companies make up ~4.2% of the Vanguard Energy ETF ETF (VDE).

APA’s capex

APA’s capex has fallen significantly in 2015. In 2Q15, APA generated surplus CFO to capex, which explains the positive FCF. In 3Q15, while capex levels remained mostly the same, CFO fell, which explains the company’s negative FCF. APA noted in its earnings conference call that it would have maintained a surplus in 3Q15 as well if commodity prices hadn’t eroded.

APA also indicated that its 2016 capital program will target a positive free cash flow for the year. APA said that it will fund capex from operating cash flows and not from asset sales.

APA has demonstrated its ability to spend within its CFO even in a $50 per barrel oil scenario. It has also demonstrated its continued efforts to reduce cost and capital with no major fall in production volumes. The company’s 2016 positive FCF goal seems achievable, especially if there is crude oil price recovery to go with it.

Next, we’ll be looking at Apache’s historical valuation.