Las Vegas Sands’ adjusted property earnings double in Singapore

Las Vegas Sands’ adjusted property EBITDA at Marina Bay Sands in Singapore doubled, reaching a property record of $518.5 million, up ~100% year-over-year.

Nov. 27 2019, Updated 7:21 p.m. ET

Adjusted property earnings

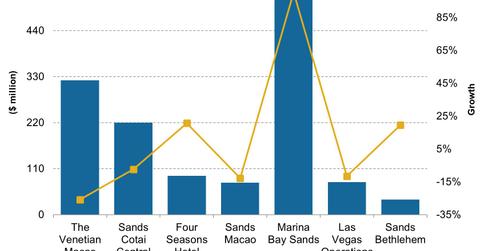

Las Vegas Sands’ (LVS) adjusted property earnings before interest, taxes, depreciation, and amortization (or EBITDA) increased 10.9% year-over-year to $1.35 billion in the fourth quarter of 2014. Adjusted property EBITDA at LVS’s Macao operating properties stood at $711.2 million.

The above chart shows that LVS’s adjusted property EBITDA at Marina Bay Sands in Singapore doubled, reaching a property record of $518.5 million, up ~100% year-over-year.

This growth in adjusted property EBITDA in Singapore is attributable mainly to strong growth in mass gaming and retail mall revenues as well as the positive impact of a $90.1 million property tax refund during the fourth quarter of 2014.

Adjusted property EBITDA margin

The adjusted property EBITDA margin increased 260 basis points to 37.2% in 2014, compared to 34.6% in 2013. The strong growth in mass market gaming revenue in Macao as well as stronger results at Marina Bay Sands in Singapore significantly contributed to the EBITDA margin expansion in 2014.

Key takeaways from 4Q14 earnings call

Sheldon Adelson, chairman and CEO (chief executive officer) of LVS, said, “In Singapore, we have around 60% EBITDA share in a duopoly market, 50% more than the other guy. Not only are we unique in being licensed in the two largest gaming markets in Asia, but we are also by a very wide margin the profit leader in both markets. But not only are we more profitable, revenue diversification means that our earnings are more defensive and predicable and of higher quality.”

Investing through ETFs

Investors who would like to hold a diversified position in leisure companies may invest in ETFs such as the Consumer Discretionary Select Sector SPDR Fund (XLY) and the VanEck Vectors Gaming ETF (BJK). BJK is more levered toward casino companies such as Las Vegas Sands, Wynn Resorts (WYNN), MGM Resorts International (MGM), and Melco Crown Entertainment (MPEL). Las Vegas Sands (LVS) comprises ~8.3% of the VanEck Vectors Gaming ETF (BJK).