Net Debt-to-EBITDA Expectations for Intermediate Gold Miners in 2015

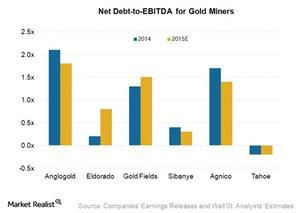

In 2015, the average net debt-to-EBITDA ratio of the six intermediate gold miners we’ve been evaluating in this series is 0.9x—a similar level to 2014.

Nov. 20 2020, Updated 11:51 a.m. ET

Net debt-to-EBITDA ratio

A company’s net debt-to-EBITDA ratio indicates the number of years it will take to repay its net debts using core business profits. The ratio is widely used by credit rating agencies, investors, and lenders.

At the same time, a company’s EBITDA is considered as core business profit because it is not affected by capital structure, tax, and non-cash items. EBITDA is thus very useful in comparing firms with different capital structures. A lower ratio is better for the company. But if a gold mine company consistently generates enough EBITDA to pay its debt liability, then a higher leverage wouldn’t be considered bad until it consistently maintains its net debt-to-EBITDA ratio at par with peers and historical averages.

In 2015, the average net debt-to-EBITDA ratio of the six intermediate gold miners we’ve been evaluating in this series—Agnico Eagle Mines (AEM), Anglogold Ashanti (AU), Gold Fields (GFI), Tahoe Resources (TAHO), Sibanye Gold (SBGL), and Eldorado Gold Corporation (EGO)—is 0.9x, which is at the similar level of 2014 EBITDA.

Further comparisons

Anglogold (AU) has highest net DE (debt-to-equity) ratio, whereas Tahoe Resources (TAHO) has negative net debt/equity ratio as it has more cash than its debt level. Anglogold’s net debt-to-EBITDA ratio was 2.1x in 2014 and is expected to improve it in 2015 to 1.8x on lower debt. The company sold its Cripple Creek & Victor mine for $820 million to reduce its debt in early 2015.

While Eldorado Gold’s (EGO) net debt-to-equity ratio is expected to increase significantly in 2015 from 0.2x in 2014 to 0.8x in 2015. This is primarily due to lower profits, as cash costs increased in the first half of 2015.

Analyst estimates

According to Wall Street analyst estimates, Gold Fields (GFI) is expected to report a marginal hike in its ratio, from 1.3x in 2014 to 1.5x in 2015. Agnico Eagle (AEM) and Sibanye Gold (SBGL) are expected to improve their net debt-to-equity ratios slightly in 2015, to 1.4x (compared to 1.7x in 2014) and 0.3x (compared to 0.4x in 2014), respectively.

Anglogold and Eldorado make up 8.3% of the VanEck Vectors Gold Miners ETF (GDX). Investors can get exposure to gold through investing in various gold-backed ETFs like GDX and the SPDR Gold Trust (GLD), among others.

Now let’s move to an analysis of the financial strength of our six intermediate gold mining companies in the next part of this series.