Must-Read Notes on Barrick Gold’s 3Q15 Earnings and Conference

Barrick Gold (ABX) reported its 3Q15 results on October 28 after market hours and held its conference call the next day. Its results beat market expectations.

Oct. 30 2015, Published 1:11 p.m. ET

Earnings beat expectations

Barrick Gold (ABX) reported its 3Q15 results on October 28 after market hours and held its conference call the next day. Its results beat market expectations. It reported earnings per share (or EPS) of $0.11, above consensus estimates of $0.07. The strong earnings were due to stronger operational performance and lower exploration expenses.

Barrick also beat production estimates with 1.66 million ounces of gold production. The production was 15% higher quarter-over-quarter (or QoQ). The improved production performance was supported by better-than-expected performance from the Goldstrike and Cortez mines.

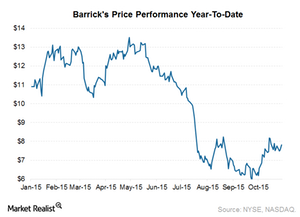

Barrick’s share price reacted positively to the results, improved guidance, and progression toward its debt target. The share price was up 2% after the announcement.

Upgraded guidance

Barrick Gold delivered strong cost performance with all-in sustaining costs (or AISC) coming in at $771 per ounce compared to $895 per ounce in 2Q15. The company has lowered its AISC guidance for 2015 from $840–$880 per ounce to $830–$870 per ounce. Barrick also tightened its gold production guidance range from 6.1 million–6.4 million ounces to 6.1 million–6.3 million ounces. This mainly reflects lower anticipated gold production from Acacia Mining.

In this series

In this series, we’ll analyze Barrick Gold’s 3Q15 earnings report and conference call. We’ll look at the firm’s production and cost performance and the reasons for its improved cost guidance. We’ll also discuss recent developments with its asset sales and the company’s progress toward its debt reduction target. We’ll see how management is trying to position the company in this volatile gold price environment.

Barrick’s peers Newmont Mining (NEM) and Goldcorp (GG) released their 3Q15 results on October 29. We’ll discuss their performance relative to Barrick throughout this series.

Investors can access the gold industry through gold-backed ETFs such as the SPDR Gold Trust (GLD) and GDX. ABX, NEM, and GG make up 20.2% of GDX’s holdings.