Key Takeaways from Alcoa’s 1Q 2015 Earnings

Alcoa (AA) reported its 1Q 2015 earnings on April 8. It reported net income of $195 million on revenues of $5.8 billion.

April 13 2015, Updated 2:36 p.m. ET

Alcoa’s 4Q earnings

Alcoa (AA) reported its 1Q 2015 earnings on April 8. It reported net income of $195 million on revenues of $5.8 billion. The EPS (earnings per share) stood at $0.28 after excluding special items. Alcoa’s 1Q financial results failed to cheer investors. Its share price fell by ~5% in early trading, but it did recover modestly later in the day.

Alcoa has a history of kick-starting the earnings season. Kaiser Aluminum (KALU) is expected to release its 1Q earnings on April 28, and Century Aluminum’s (CENX) earnings are expected on April 30. CENX currently forms 2.5% of the SPDR S&P Metals and Mining ETF (XME). Reliance Steel and Aluminum (RS) makes up ~4% of XME.

Series overview

In this series, we’ll discuss the key takeaways from Alcoa’s 1Q earnings. We’ll see how these results are another step in Alcoa’s transformation. In the latter part of the series, we’ll analyze how Alcoa is placed in the current market.

Integrated operations

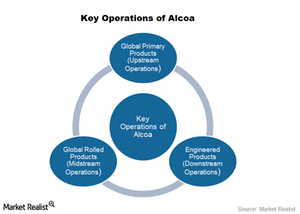

Alcoa is a global leader in lightweight metals technology, engineering, and manufacturing. It employs over 60,000 people in more than 30 countries and delivers value-added products made of aluminum, titanium, and nickel. These products are widely used in the automotive, aerospace, construction, packaging, and energy sectors.

Alcoa is an integrated aluminum company. This means that it has operations across the aluminum industry value chain. Its operations consist of three business groups:

- Upstream

- Midstream

- Downstream

How have these business segments contributed to Alcoa’s 1Q earnings? We’ll find out in the next part of our series.