Future Sales Drivers for Nike’s Integrated Marketplace Model

Nike is expecting sales through wholesalers to grow at a mid- to high-single compounded annual growth rate over the next five years through fiscal 2020.

Nov. 2 2015, Updated 7:04 a.m. ET

Nike updates projections for wholesale and retail channels

At Nike’s (NKE) biennial Investor Day 2015, held on October 14, the company revealed sales projections for its Integrated Marketplace model. The model consists of sales made through a mix of wholesale and direct-to-consumer, or DTC, channels.

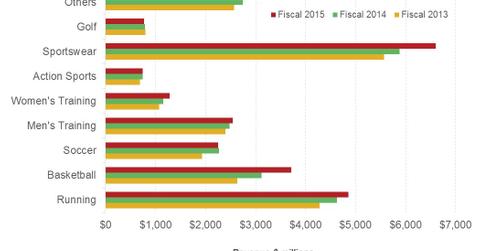

Wholesale channel sales consist of sales made through other retailers for sporting goods (XRT), like Foot Locker (FL), and DICK’S Sporting Goods (DKS), among others. This is Nike’s largest selling channel, clocking sales of $21.9 billion on a wholesale equivalent basis in fiscal 2015.

Sales projections

Nike is expecting sales through wholesalers to grow at a mid- to-high-single digit CAGR (Compounded Annual Growth Rate) over the next five years through fiscal 2020.

The company is increasingly looking at premiumizing its distribution model. A key element of its wholesale channel sales would be the expansion of its women’s business, slated to almost double to $11 billion by fiscal 2020.

Wholesale partnerships

Over the last year, Nike opened 173 premium spaces, targeting the female customer, including both partnerships and owned stores. These include spaces at SIX:02, a women’s only concept store by Foot Locker (FL), and Chelsea Collective with DICK’S Sporting Goods (DKS). Nike also partnered with department stores like Macy’s (M) and Kohl’s (KSS). Over the next five years, Nike is planning to open about a 1000 new premium locations, in a bid to double its women’s business to $11 billion[1. As per comments by Christiana Shi, President – Direct-to-Consumer].

Nike is also looking at capitalizing on its Jordan Brand opportunity. Nike plans to report the brand as a separate business apart from basketball, doubling its sales to $4.5 billion by fiscal 2020. Nike is the market leader by far in basketball, with a market share of over 90% in basketball footwear in the United States according to the NPD Group].

Jordan Brand is a critical enabler for Nike’s leadership in basketball. Partnerships like the House of Hoops with Foot Locker (FL) will drive both category sales as well as sales for the wholesale channel for Nike.

Nike and Foot Locker together constitute 1% of the portfolio holdings in the Vanguard Growth ETF (VUG).