Analyzing Silver’s Fundamentals

When analyzing the performance of a metal, investors should look at its fundamentals. In this series, we’ll look at various metrics for silver and other precious metals.

May 18 2017, Updated 7:37 a.m. ET

Silver output has dropped

When analyzing the performance of a metal, investors should look at its fundamentals. For the first time since 2002, global silver scrap mining production has dropped.

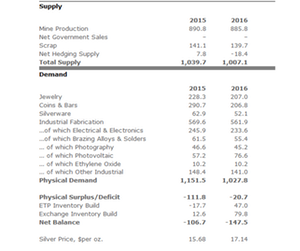

Silver production, including mine production and scrap, fell 32.6 million ounces between 2015 and 2016. The lower production was primarily driven by lower by-product output from the lead, zinc, and gold sectors. Lower silver scrap supply to the market and a contraction in producer hedging also contributed to the decrease in supply. Approximately 1 billion ounces of silver came to the market in 2016, which represents a mere 0.32% of the overall silver market.

Silver uses

Silver is primarily used for jewelry, solar panels, and photovoltaic systems. In 2016, jewelry demand dropped to 207 million ounces. The demand for silver coins and bars was ~206.8 million ounces. Coin and bar sales have been impacted in 2017.

On the other hand, the use of silver for solar panels and photovoltaic systems increased in 2016 and early 2017. However, the market for silver became choppy in mid-April.

Silver funds and miners

Price fluctuations in silver are tracked by funds such as the ETFS Physical Silver Shares ETF (SIVR) and the iShares Silver Trust ETF (SLV), which have both fallen 9.1% in the last trading month.

Silver mining funds Silver Wheaton (SLW), Coeur Mining (CDE), Pan American Silver (PAAS), and Hecla Mining (HL) have all recovered in the last week after a large decline. These four stocks have risen 8.6%, 12%, 10.3%, and 10.4%, respectively, on a five-day trailing basis.