Why Essex Property Trust Trades at a High Price-to-FFO Multiple

A close look at Essex Property Trust’s trailing-12-month price-to-FFO multiple shows that it’s in line with its historical valuation.

Oct. 16 2015, Updated 11:05 a.m. ET

Price-to-FFO multiple

The most common way of calculating the relative value of a REIT such as Essex Property Trust (ESS) is the price-to-FFO (funds from operations) multiple. The FFO is widely used because it is the main earnings metric for REITs similar to EPS (earnings per share) in other industries. price-to-FFOx is equivalent to the PE (price-to-earnings) ratio used in other industries.

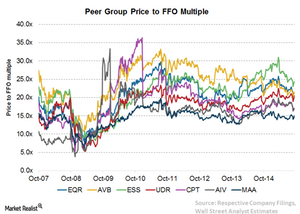

Peer group price-to-FFO multiple

A closer look at Essex Property Trust’s trailing-12-month price-to-FFO multiple shows that it is in line with its historical valuation. Over the last eight years, Essex Property Trust’s price ranged between 8.2x–30.9x of its FFO, with a current price-to-FFO multiple of around 22.9x. During the housing crisis, Essex Property Trust experienced its lowest price-to-FFO multiple. Meanwhile, the company recorded the highest multiple in March 2015.

At this multiple, Essex Property Trust’s stock is trading at the highest price-to-FFO multiple among its peers in the apartment REIT segment. For example, AvalonBay Communities (AVB) is trading at 22x, followed bt Equity Residential (EQR) at 21.1x, then UDR (UDR) at 20.4x. On the other hand, Camden Property Trust (CPT) is trading at a much a multiple of 16.2x. The industry average price-to-FFO multiple is 18.9x.

Highest multiple for Essex Property Trust

Historically, a higher price-to-FFO multiple for Essex Property Trust signifies that it was able to provide consistent capital value return along with a steady dividend yield to investors. Currently, Essex Property Trust offers a dividend yield of 2.5%, slightly lower than the yield of its major competitors. For example, Equity Residential (EQR) offered a dividend yield of 2.9%, followed by AvalonBay Communities (AVB) at 2.9%, then Camden Property Trust at 3.8%. The SPDR S&P Dividend ETF (SDY) invests 1.2% of its portfolio in Essex Property Trust.

In the next part of this series, we’ll discuss investment in REITs through ETFs.