Coty’s Growth Barriers: Weaknesses and Threats

A limited distribution strategy led to Coty’s high reliance on specific channels or departments for specific products. Coty faces stiff competition from established luxury brands and local regional brands.

Nov. 2 2015, Updated 10:04 a.m. ET

Limited product portfolio

Coty Inc. (COTY) is a leading fragrance and cosmetics company. Unlike its peers Procter & Gamble (PG) and Unilever (UL), Coty and Estée Lauder (EL) have a limited product portfolio that reduces their brand diversification.

Unlike detergents and laundry additives, cosmetic and fragrance sales are subject to seasonal holidays such as Valentine’s Day, Christmas, Mother’s Day.

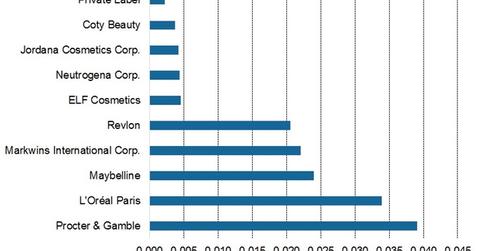

The above graph shows that Coty was among the leading blush vendors in the US in 2013 based on sales. Coty’s blush sales were $3.7 million. P&G had the highest blush sales, totaling $39.1 million. P&G’s drugstore cosmetics brands CoverGirl and Max Factor will be sold to Coty as a result of their agreement, increasing Coty’s color cosmetics market share.

Limited distribution strategy

Coty’s limited distribution strategies also limit consumer reach. For example, Coty’s skin care and body care brands like Lancaster and philosophy are sold in prestige distribution channels like department stores and high-end salons and spas. This a competitive disadvantage for Coty.

Dependence on retail stores

In addition, a limited distribution strategy has led to Coty’s high reliance on specific channels or departments for specific products. For instance, Walmart (WMT) is Coty’s largest retailer. Walmart sells products primarily within the US and accounted for 7% of Coty’s consolidated net revenues for fiscal 2015.[1. Year ended June 30, 2015]

Coty faces stiff competition from established luxury brands as well as local regional brands. Companies like LVMH Moët Hennessy Louis Vuitton (LVMUY), L’Oréal (LRLCY), and Shiseido (SSDOY) may be better equipped than Coty to respond to a quickly changing economic environment. Immediate responsiveness to changing conditions also helps in growing the customer base.

Counterfeit products

With the advent of digital channels, there has been a surge in the sales of counterfeit products. The increase in fake products has been growing in recent years, driven by the Internet-based counterfeit market. The abundance of counterfeit goods and accessories adversely affects the sales of Coty’s products. This is a major threat to Coty and its peers, and it also hurts Coty’s brand image.

Negative currency threat

Increasing labor costs and the threat of adverse currency movements could also significantly impact Coty’s revenue and margins.

Coty has exposure in the First Trust US IPO Index ETF (FXP) with ~0.1%[2. Updated as of October 1, 2015] of the total weight of the portfolio.