Can Coca-Cola and PepsiCo Improve Margins amid Rising Costs?

Coca-Cola’s (KO) decision to refranchise its bottling operations has helped it transform into a capital-light business.

Jan. 25 2019, Updated 9:01 a.m. ET

Coca-Cola’s margin improvement

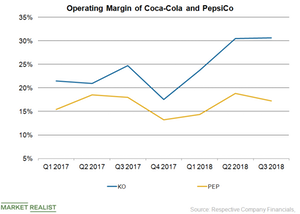

Coca-Cola’s (KO) decision to refranchise its bottling operations has helped it transform into a capital-light business. Refranchising has also driven improvements in Coca-Cola’s margins as exposure to the low-margin bottling business has come down. Coca-Cola’s gross and operating margin expanded in each of the first three quarters of 2018.

Overall, Coca-Cola’s gross margin increased to 63.5% in the first three quarters of 2018, compared to 62.1% in the first three quarters of 2017. Coca-Cola’s operating margin increased by 610 basis points to 28.5% in the first three quarters of 2018. On an adjusted basis, Coca-Cola’s operating margin increased to 32.1% in the first three quarters of 2018, compared to 27.2% in the first three quarters of 2017. The significant improvement reflected the impact of the divestiture of bottling operations and ongoing productivity initiatives.

PepsiCo’s gross margin declined in each of the first three quarters of 2018. Overall, PepsiCo’s gross margin declined 48 basis points to 54.7% in the first nine months of 2018. The company’s operating margin declined in two of the first three quarters of 2018.

Compared to Coca-Cola, PepsiCo’s operating margin has been lower in the recent quarters. PepsiCo’s reported operating margin fell 50 basis points to 17.0% in the first nine months of 2018. PepsiCo’s adjusted operating margin declined about 39 basis points in the first nine months of 2018. PepsiCo’s operating margin was adversely hit by higher commodity costs and a rise in marketing expenses.

Higher costs to impact margins

Commodity cost inflation and higher freights costs are expected to drag on the profitability of several consumer companies, including Coca-Cola and PepsiCo. Also, investments in growth initiatives are likely to put further pressure on margins.

Both Coca-Cola and PepsiCo have productivity programs in place to improve margins. Coca-Cola is on track to generate productivity savings of $3.8 billion by 2019 through streamlining its operations and other efficiency measures. PepsiCo’s productivity plan aims to generate savings of $1 billion on an annualized basis over the 2015 to 2019. PepsiCo is investing in manufacturing automation, optimizing its manufacturing network, and simplifying its organization structure as part of its productivity initiatives.

These beverage companies are also raising the prices of their products to combat increased costs. Let’s look at analysts’ recommendations for Coca-Cola in the next part of this series.