LME Warehouse Data Indicating Support For Metal Prices, But XME Collapses

Analysis of base metal inventories helps us understand the price and usage trends of the respective base metal, as well the price trends of base metal mining companies.

Nov. 9 2015, Updated 12:05 p.m. ET

Relationship between inventory level and price

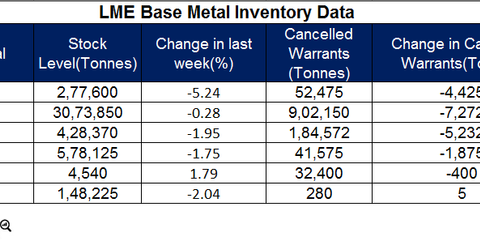

Metal inventories and trends help assess short term drivers of stocks like Rio Tinto (RIO), BHP Billiton (BHP), Glencore (GLEN), Freeport-McMoRan (FCX), as well as base metal ETFs like the PowerShares DB Base Metals Fund (DBB). Typically, inventory levels and metal prices share an inverse relationship that holds well for long-term trends, all else being equal. Below are the most recent numbers coming from the LME (London Metals Exchange). Even though inventory data was supportive of prices, mining ETFs like the Spider S&P Metals and Mining ETF (XME) fell by 4.21% on Monday

Cancelled warrants

Cancelled warrants (or cancelled tonnage) represents the warrants that have been cancelled and are unavailable for trading. These cancelled warrants are no longer available at the LME (London Metal Exchange) warehouses and are booked for removal from warehouses by the owner. The rise in inventories and fall in cancelled warrants indicates a negative trend in base metals prices, whereas a fall in inventories and rise in cancelled warrants supports base metal prices.

Analysis of LME inventory data

Except for LME tin, the LME warehouse levels of all base metals fell in the week ending on Ocotber 23rd, 2015. The LME warehouse levels of copper fell by 5.3% last week and reached 277,600 tons. The LME copper inventories reached a peak of 371,250 tons in August, and have been in a downtrend trend ever since. Since the beginning of 2015, copper inventories rose by 57%, whereas LME 3M Copper prices fell by 18%. On October 23, the LME copper’s cancelled warrants dropped by 4,425 tons, reaching 52,475 tons.

The LME stock levels of aluminum remained almost unchanged last week with a relatively small fall of 0.27%. The aluminum inventories have been in a downtrend since the beginning of 2015, and fell by 27%. On October 23, the LME aluminum’s cancelled warrants fell 7,272 tons to reach 902,150 tons.

The LME warehouse levels of nickel fell by 2% last week to 429,720 tons. The LME warehouse level of nickel made a peak of 470,376 tons on June 4, 2015 and has been in a downtrend ever since. Since the beginning of 2015, nickel inventories rose by 3.7%, whereas LME 3M Nickel prices fell by 30%. On October 23, the LME nickel’s cancelled warrants dropped 5,232 tons to 184,572 tons.

The LME stocks of zinc fell by 1.8% last week to 578,250 tons. On October 23, the LME zinc’s cancelled warrants dropped 1875 tons to 41,575 tons. The LME inventory levels of lead fell by 2% last week, whereas LME inventory levels of tin rose by 1.8%. Since the beginning of 2015, the LME inventory level of tin fell by 62%. Considering the recent movement in the LME inventory levels of base metals , all stock levels are in downtrend and can support the falling base metal prices in long run.