Philip Morris’s Strengths and Growth on the Horizon

One of Philip Morris’s biggest strengths is its large brand portfolio. The global demand for its products fuels its cash flow growth and innovations.

Sept. 15 2015, Updated 9:06 a.m. ET

Strong brand portfolio

One of Philip Morris International’s (PM) biggest strengths is its large brand portfolio, which includes dozens of popular regional, national, and international brands like Marlboro to Parliament. It also develops, markets, and distributes multi-billion dollar tobacco brands like Indonesia’s Kretek and the France’s ST Dupont Paris.

Cash generation ability and leading market share

Philip Morris has a geographically diverse business. The global demand for its high-margin products helps the company maintain a healthy cash flow growth, which it uses, in turn, to fund innovative products. The company has a market share of 15.6% of the total international cigarette market outside the US.

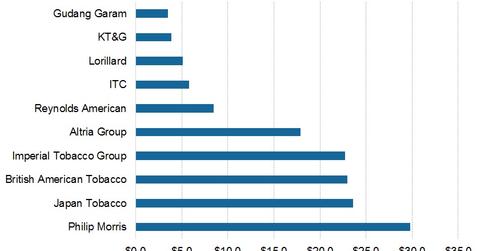

According to a Forbes report cited in Statista, Philip Morris came in first among the leading top ten tobacco companies worldwide in 2014, based on its net sales of $29.8 billion, the highest among its peers. Japan Tobacco (JAPAY), British American Tobacco (BTI), and Reynolds American (RAI) reported revenues of $23.6 billion, $23.0 billion, and $22.7 billion, respectively. Altria Group (MO) as a whole had revenue of $17.9 billion.

Emerging market opportunity

In many emerging markets like Eastern Europe, Africa, and the Middle East, the popularity of smoking is increasing with rapid population growths. Philip Morris has identified these countries as emerging smoking markets. Accordingly, the company has invested in new ventures in the United Arab Emirates and Jordan over the past year.

Going electronic

Amid pressures to limit consumption of traditional tobacco products, tobacco companies are developing new smokeless tobacco products like vaporized nicotine e-cigarettes, which can reduce the effects of health risks. In an attempt to stay ahead of demand, Philip Morris has aligned itself with Altria in marketing the MarkTen electronic cigarette and the chewable Vuse.

Philip Morris has exposure in the iShares Core S&P 500 ETF (IVV), with 0.7% of the portfolio’s total weight as of August 13, 2015.