Silver Prices Show Positive Correlation with the Australian Dollar

Drop in silver prices among other precious metals With global commodity and metal prices falling in the volatile month of August, silver has been no exception. The economic slowdown in China has been slowing the demand across various commodities. Precious metals like gold and silver have been under pressure. The strength in the US dollar […]

Sept. 10 2015, Updated 12:18 p.m. ET

Drop in silver prices among other precious metals

With global commodity and metal prices falling in the volatile month of August, silver has been no exception. The economic slowdown in China has been slowing the demand across various commodities. Precious metals like gold and silver have been under pressure. The strength in the US dollar arising from depreciation of emerging market currencies has been a cause of decline in silver prices. Further, a hint by ECB (or the European Central Bank) chief Mario Draghi of increasing the monetary stimulus in order to increase inflation levels has provided further support to the US dollar index.

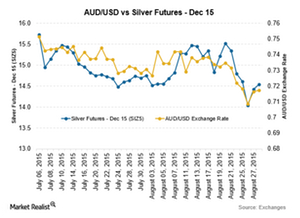

A strong correlation between the Australian dollar and silver futures

The Australian dollar is among the top silver producers in the world. Thus, any volatility in the commodity’s prices globally have an impact on the value of the Australian dollar against the US dollar. Looking at the prices of silver futures and the value of the Australian dollar over approximately a two-month timeframe from July 6 to August 28, the correlation stands at 0.65, which is a good correlation. On the other hand, Mexico, which is the largest producer of silver in the world, saw its currency, the Mexican peso, correlate with silver futures only by 0.37.

Impact on the market

The iShares Silver ETF (SLV) fell by 7.14% in the period between July 6 and August 28, 2015. The iShares MSCI Australia ETF (EWA) over the same period fell by 7.89%.

Australian ADRs (American depository receipts) were also on a negative trajectory in the above-mentioned period. James Hardie Industries (JHX) fell by 4.68%. Other mining ADRs like Pretium Resources (PVG) went up by 2.65%. Hecla Mining Company (HL), a US-based mining company, fell by 21.67% in the same period.